IN THIS ISSUE:

• How the 'Eby plan' connects to real estate

• New listings in Metro Vancouver up for September

• Meanwhile, in other news this month...

• Decor: Preparing for the change of seasons

• Busy times for Nexus sales and listings

New plan addresses B.C.’s housing issues

In the many analyses of former housing minister and premier candidate David Eby’s plan for British Columbians since it was announced last month, the most dramatic change is probably that the province would have the legal power to fast-track housing by over-riding individual municipalities.

This will be welcome news, if the plan is accepted, for builders who have seen projects tied up in red tape for periods of time so long they’re at risk of disappearing. The “housing crisis” in B.C. and many other places begins with not enough places to live, so the supply is still the dynamic.

From a real estate perspective, these are the most pertinent parts of the plan:

The 'BC Builds' Program

Given that the SUPPLY of housing is always going to limit sales, increasing the number of new homes (or apartments or condos) will surely help moderate that trend. However, it will take time, so nobody should be looking for a quick fix. The shortage of homes for sale is going to be around for a while.

The plan is designed to build “multi-family rental and purchase units in both urban and rural areas for a range of incomes.” The intention is to lock in low rates long-term by using public land held by the province and by partnering with First Nation and city governments, non-profit and private partners.

From a real estate perspective, these are the most pertinent parts of the plan:

The 'BC Builds' Program

Given that the SUPPLY of housing is always going to limit sales, increasing the number of new homes (or apartments or condos) will surely help moderate that trend. However, it will take time, so nobody should be looking for a quick fix. The shortage of homes for sale is going to be around for a while.

The plan is designed to build “multi-family rental and purchase units in both urban and rural areas for a range of incomes.” The intention is to lock in low rates long-term by using public land held by the province and by partnering with First Nation and city governments, non-profit and private partners.

A B.C. Flipping Tax

People who buy and sell residential properties within two years will be subject to a tax, to prevent speculators from making “excessive profits.” The tax (percentage not

People who buy and sell residential properties within two years will be subject to a tax, to prevent speculators from making “excessive profits.” The tax (percentage not

announced yet) will gradually decrease over the two years until it becomes zero.

Critics maintain this is unfair to ordinary home owners and restricts the sale of their homes, just because they want to move in that two-year window. It’s worth noting that Eby says there will be exceptions for “major life events” like death, divorce or loss of employment.

Changing the Game

If passed, the plan would approve secondary suites everywhere, which adds to the value of the property, and increases density in urban settings by allowing a single family home to be replaced by up to three units.

Adding densification to cities is certain to impact housing availability positively. The opposition to it is not all neighbourhoods want to participate in densification and, with the Eby plan, they would be forced to participate.

Professor Tom Davidoff, with the University of British Columbia’s Sauder School of Business, gave this analysis to CityNews:

“The deletion of single-family zoning, which is exclusionary, and regressive and inefficient, [is] bad for economic efficiency, [and is] bad for equality. Getting rid of that is a really important step and I think it has a lot of symbolic value.”

Eby addressed the flipping tax, in an interview with CBC, by saying:

“We don't want first-time home buyers competing for a place to live with a bunch of short-term speculators and investors that are driving prices up.”

To which Professor Davidoff says: "“Probably this will mostly raise revenue. It might discourage some legitimate moves, and you know, fix-up-houses-and-sell-them-type transactions, but it’ll probably raise some revenue and mostly be harmless.”

Clearly, the plan has some promising components. How it will actually unfold remains to be seen.

The plan is expected to be tabled if he is chosen premier by the Government, on December 3.

Changing the Game

If passed, the plan would approve secondary suites everywhere, which adds to the value of the property, and increases density in urban settings by allowing a single family home to be replaced by up to three units.

Adding densification to cities is certain to impact housing availability positively. The opposition to it is not all neighbourhoods want to participate in densification and, with the Eby plan, they would be forced to participate.

Professor Tom Davidoff, with the University of British Columbia’s Sauder School of Business, gave this analysis to CityNews:

“The deletion of single-family zoning, which is exclusionary, and regressive and inefficient, [is] bad for economic efficiency, [and is] bad for equality. Getting rid of that is a really important step and I think it has a lot of symbolic value.”

Eby addressed the flipping tax, in an interview with CBC, by saying:

“We don't want first-time home buyers competing for a place to live with a bunch of short-term speculators and investors that are driving prices up.”

To which Professor Davidoff says: "“Probably this will mostly raise revenue. It might discourage some legitimate moves, and you know, fix-up-houses-and-sell-them-type transactions, but it’ll probably raise some revenue and mostly be harmless.”

Clearly, the plan has some promising components. How it will actually unfold remains to be seen.

The plan is expected to be tabled if he is chosen premier by the Government, on December 3.

Meanwhile, in other news this month...

The most important real estate news is widely covered in major media outlets, and sometimes analyzed here in News From Nexus. What you'll find in this section is interesting real estate news that you're not likely to see on TV or in the mainstream newspapers.

Young Canadians older when buying first house

Young Canadians older when buying first house

A variety of studies conducted this year indicate that Canadians are about 36 years old when they become first-time home owners, 25 when they graduate from university and 29 either when they walk down the aisle or become parents, or both. And while 43 per cent of Canadians between 20 and 34 are home owners, that’s about 30 per cent lower than any other age group.

New California laws bypass local government permission

Affordable housing advocates are celebrating the passage of two laws in California that would allow developers to build apartments or townhomes on land previously used by retailers forced to vacate by online shopping. One law allows affordable housing to be built on commercial land without permission from local governments; the other allows market-rate housing on some commercial land, subject to environmental review.Guess why London price increases behind rest of UK?

Home prices in Great Britain rose by 15.5 per cent from July 2021 to July this year, according to the Office for National Statistics. However, in the city with the most expensive property (London), the increase was significantly less (9.2 per cent). The disparity was attributed to COVID, which prompted home owners to work from larger homes outside the city centres.

September statistics point to growing inventory

The headline from the Real Estate Board of Greater Vancouver this month is: “Metro Vancouver saw more home sellers and fewer buyers in September.” Translation: More listings than sales.

Going forward, that should mean with a larger inventory of properties available it will lead to more sales. What it does mean is that buyers are enjoying more homes from which to choose, so they’re probably going to be less inclined to move quickly.

As the REBGV puts it:

“With fewer homes selling and new listings continuing to come to market, inventory is beginning to accumulate, providing buyers with more selection compared to last year.

With more supply and less demand within this market cycle, residential home prices have edged down in the region over the last six months.”

With more supply and less demand within this market cycle, residential home prices have edged down in the region over the last six months.”

Naturally, it depends on the region. Each micro-market has its own demographics, its own inventory and its own range of home prices. That’s why the REBGV statistics that are released each month must always be put into context.

Naturally, it depends on the region. Each micro-market has its own demographics, its own inventory and its own range of home prices. That’s why the REBGV statistics that are released each month must always be put into context.

Having said that, the sales-to-active-listings ratio for Metro Vancouver is pretty much where it should be to provide a stable market. For September, it was 16.9 per cent, and analysts say downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

By property type, the ratio is:

• 12.4 per cent for detached homes

• 18.4 per cent for townhomes

• 20.9 per cent for apartments

It’s the first time in many months that the sales-to-active-listings ratio has been that close to “normal” for all three housing categories.

• 12.4 per cent for detached homes

• 18.4 per cent for townhomes

• 20.9 per cent for apartments

It’s the first time in many months that the sales-to-active-listings ratio has been that close to “normal” for all three housing categories.

One of the factors is an interest rate that has been moving up every month or two. That was also addressed in the REBGV’s monthly release:

“With the Bank of Canada and other central banks around the globe hiking rates in an effort to stamp out inflation, the cost to borrow funds has risen substantially over a short period. This has resulted in a more challenging environment for borrowers looking to purchase a home, and home sales across the region have dropped accordingly.”

Sales in September were 35.7 per cent below the 10-year average for that month. The year-to-year September decrease was 46.4 per cent, and sales were down by 9.8 per cent from August 2022.

Meanwhile, new listings were up from August (by 27.1 per cent) and down from September 2021 (18.2) per cent.

Like almost all statistical analyses, these are the indicators used to speculate where the real estate market may be headed.

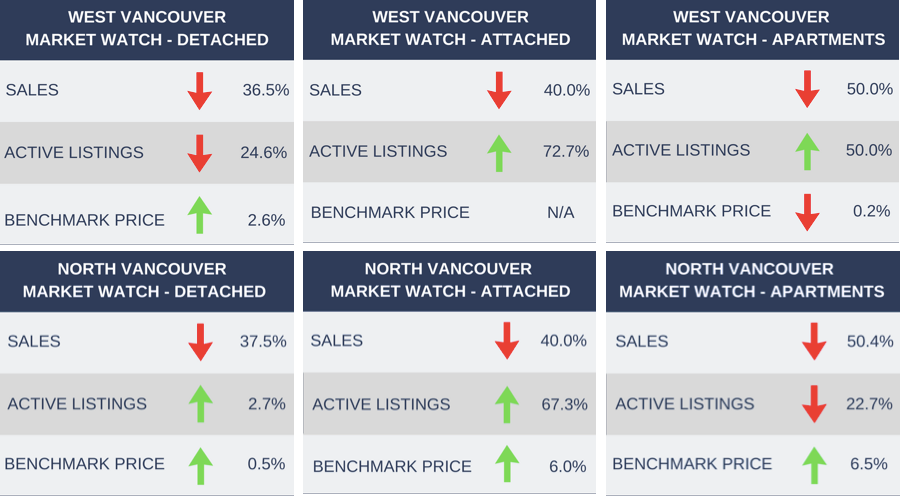

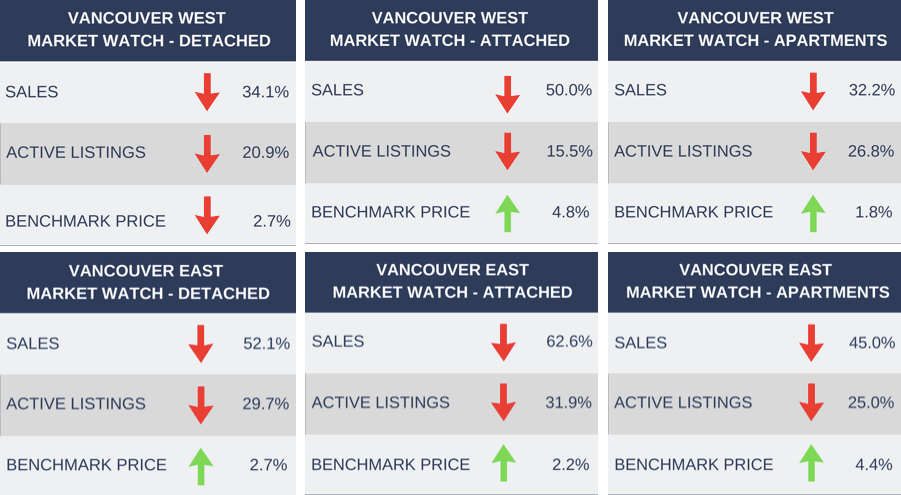

Statistics for the markets of West Vancouver, North Vancouver, Vancouver West and Vancouver East are graphically displayed below, as always.

The story of Laneway vs Character Homes

Laneway homes are often mentioned as one of the City of Vancouver can increase densification, and that’s true. What is sometimes overlooked is that laneway residences do not increase home ownership.

Living in a laneway home means being a renter, because they are not allowed to be sold. The owners can add a laneway home to their property and increase its value by having a second residence. Because there is no strata, at least for now, the resident of that laneway home cannot own it.

There is an “exception.”

If the principal residence on the property is a Character House, multiple homes can be added and be stratified. A Character Home is one built before 1940 that qualifies to be renovated. There’s a property being developed in Vancouver now which — when completed early in 2023 — will have six homes, and six home owners.

Those details will be featured in an upcoming issue of News With Nexus.

That the City of San Francisco has required all new single-family homes and multi-family dwellings up to three storeys, and that all buildings up to 10 storeys, to have solar panels on at least 15 per cent of their rooftops?

Decor: Transitioning from fall to winter

Every month, News From Nexus features ideas or observations about Decor,

or ways you can make your home more appealing.

It may be a bit of a stretch, but “decor” can also be applied to the look of your home and surroundings when the seasons change. That being said, the transition from one season to the next comes with a to-do list.

The longest to-do list is, predictably, from autumn to winter because, well, it’s winter!

The longest to-do list is, predictably, from autumn to winter because, well, it’s winter!

Completing that transition list is perhaps the most important one. Chores that aren’t finished before the cold, rainy weather sets in are at best more difficult to do, and at worst put on hold until spring. They also are chores that often help keep you safe, warm and relaxed.

The best place to begin is with a top-to-bottom inspection. Everybody’s list will be a little different, but here’s a start:

• Check doors and windows for drafts, adding weatherstripping as necessary, to keep the heat in and the cold out.

• Test smoke and carbon monoxide detectors, also fire extinguishers.

• Remove window air conditioners, and service them before storing.

• Inspect the roof for leaks, wind damage and moss growth.

• Clean out gutters as necessary.

• Replace the furnace filter, and having an HVAC inspection is a good idea if the furnace has some age.

• Turn off (and insulate) exterior faucets, and drain sprinkler systems and garden hoses.

• Reverse the direction of ceiling fans — it might seem strange, but if your ceiling fan is set to go in a clockwise direction in cool weather, at low speed, it will move cold air up toward the ceiling and move the warm air down, and manufacturers of ceiling fans suggest this can reduce heating bills up to 15 per cent.

• Check and/or replace outdoor “tools”…brooms, ice scrapers, shovels, snow movers and even work gloves!

• Stock up on sand, salt or de-icer (and remember to put an ice scraper in the car).

• Store and/or cover outdoor furniture, which can extend its life.

• Clean the chimney and fireplace flue, checking for creosote build-up, birds nests and other obstructions.

• Assemble an emergency preparedness kit.

After that…wait for winter!

• Check doors and windows for drafts, adding weatherstripping as necessary, to keep the heat in and the cold out.

• Test smoke and carbon monoxide detectors, also fire extinguishers.

• Remove window air conditioners, and service them before storing.

• Inspect the roof for leaks, wind damage and moss growth.

• Clean out gutters as necessary.

• Replace the furnace filter, and having an HVAC inspection is a good idea if the furnace has some age.

• Turn off (and insulate) exterior faucets, and drain sprinkler systems and garden hoses.

• Reverse the direction of ceiling fans — it might seem strange, but if your ceiling fan is set to go in a clockwise direction in cool weather, at low speed, it will move cold air up toward the ceiling and move the warm air down, and manufacturers of ceiling fans suggest this can reduce heating bills up to 15 per cent.

• Check and/or replace outdoor “tools”…brooms, ice scrapers, shovels, snow movers and even work gloves!

• Stock up on sand, salt or de-icer (and remember to put an ice scraper in the car).

• Store and/or cover outdoor furniture, which can extend its life.

• Clean the chimney and fireplace flue, checking for creosote build-up, birds nests and other obstructions.

• Assemble an emergency preparedness kit.

After that…wait for winter!

"You helped us find our family home and we are thrilled to recommend you to, among others, our friends and families. You had a way of making us feel like we were your number one priority and you went out of your way to make sure we found the perfect home for our family.”

— Pam and Pete Sack, West Vancouver

Last call for watching cruise ships

Except for a 10-hour stop by the Crown Princess in November, the cruise ship season concludes this month for Vancouver ship watchers. In fact, you'll be able to see only three cruise ships after the 15th of the month, as the industry turns its vessels south for winter cruising.

Below is the final schedule, which is also listed at nexusrealtycorp.com where you can click on individual links to find out more about each ship.

And come April, they'll be back!

Photo credits

Fall scene with REBGV story: Sean Wu, Unsplash;

Cruise ship: Video Openhouse;

Decor: Nathan Walker @nwphoto

Real Estate Monthly Statistics

The following statistics for West Vancouver, North Vancouver, Vancouver West and Vancouver East compare September 2022 to September 2021 (note: sales refers to number of sales, not to sale prices).

Benchmark Price: Estimated sale price of a benchmark property. Benchmarks represent a typical property within each market.

To see more information on local stats, please click here.

$1,598,000

2423 Mathers Avenue, West Vancouver

605 - 1480 Duchess Avenue, West Vancouver

What's happening in October throughout the Lower Mainland, with protocols included as currently known.

Until October 9

Vancouver International Film Festival

1181 Seymour St.

Over 200 films, in every imaginable genre, as well as live talks and events

viff.org

Vancouver International Film Festival

1181 Seymour St.

Over 200 films, in every imaginable genre, as well as live talks and events

viff.org

Until October 10

Richmond Night Market

8351 River Road, Richmond

The largest night market in North America, weekend evenings

richmondnightmarket.com

Vancouver Canucks at Rogers Arena

October 5: vs Edmonton Oilers, 7 p.m. (pre-season)

October 7: vs Arizona Coyotes, 7 p.m. (pre-season)

October 22: vs Buffalo Sabres, 7 p.m.

October 24: vs Carolina Hurricanes, 7:30 p.m.

October 28: vs Pittsburgh Penguins, 7 p.m.

www.canucks.com/schedule

October 7-31

Fright Nights at Playland

2901 East Hastings St.

Playland transformed into a super-spooky Halloween experience, complete with haunted houses, roving monsters and thrilling rides (final year for the Hollywood Horrors haunted house); onj select nights, Wednesdays to Saturday 6 pm.-midnight; Sundays 6 - 11 p.m.

frightnights.ca

B.C. Lions at B.C. Place Stadium

October 15: vs Winnipeg Blue Bombers, 7 p.m.

www.bclions.com/schedule

Until October 16

BC Culture Days

Various locations

A national celebration of arts and culture, with a multitude of events throughout the province

https://culturedays.ca/en/bc

October 20-23

Vancouver Fall Home Show

Vancouver Convention Centre

Your go-to marketplace for all things home…decor, renos and more; Thursday 4-9 p.m., Friday 12-9 p.m., Saturday 10 a.m. - 9 p.m., Sunday 10 a.m. - 6 p.m.

www.vancouverfallhomeshow.com

October 21

Zac Brown Band Out in The Middle Tour

Rogers Arena

Grammy-award winning country rockers return to touring, 7 p.m.

https://zacbrownband.com

October 21-22

Elton John: Farewell Yellow Brick Road Final Tour

BC Place Stadium

Still touring after more than half a century, the rock-'n-roll icon takes the stage for the final concerts in Vancouver at 8 p.m.

www.destinationvancouver.com

October 29

Carly Rae Jepsen: So Nice Tour

Doug Mitchell Thunderbird Sports Centre

BC-born Juno Award winning artist returns home, 8 p.m.

thunderbirdarena.ubc.ca/carly-rae-jepsen

Until October 31

Fin-tastic Fall Days

Vancouver Aquarium, Stanley Park

Discover new spooky surprises; 10 a.m - 5 p.m. daily

www.vanaqua.org

Until October 31

HowlOver Canada

FlyOver Canada, Canada Place

A chance to soar from coast to coast with some spooky characters, all on your way to a haunted music festival

www.flyovercanada.com/halloween

Until October 31

Pumpkins After Dark

Central Park, Burnaby

A Halloween walk-through family event, complete with hundreds of carved Jack-O-Lanterns

pumpkinsafterdark.com

October 31

The Wiggles

Vancouver Playhouse, 600 Hamilton

Australian children’s entertainment group has thrilled kids everywhere for more than 30 years, at 3:30 p.m.

https://www.thewiggles.com

Richmond Night Market

8351 River Road, Richmond

The largest night market in North America, weekend evenings

richmondnightmarket.com

Vancouver Canucks at Rogers Arena

October 5: vs Edmonton Oilers, 7 p.m. (pre-season)

October 7: vs Arizona Coyotes, 7 p.m. (pre-season)

October 22: vs Buffalo Sabres, 7 p.m.

October 24: vs Carolina Hurricanes, 7:30 p.m.

October 28: vs Pittsburgh Penguins, 7 p.m.

www.canucks.com/schedule

October 7-31

Fright Nights at Playland

2901 East Hastings St.

Playland transformed into a super-spooky Halloween experience, complete with haunted houses, roving monsters and thrilling rides (final year for the Hollywood Horrors haunted house); onj select nights, Wednesdays to Saturday 6 pm.-midnight; Sundays 6 - 11 p.m.

frightnights.ca

B.C. Lions at B.C. Place Stadium

October 15: vs Winnipeg Blue Bombers, 7 p.m.

www.bclions.com/schedule

Until October 16

BC Culture Days

Various locations

A national celebration of arts and culture, with a multitude of events throughout the province

https://culturedays.ca/en/bc

October 20-23

Vancouver Fall Home Show

Vancouver Convention Centre

Your go-to marketplace for all things home…decor, renos and more; Thursday 4-9 p.m., Friday 12-9 p.m., Saturday 10 a.m. - 9 p.m., Sunday 10 a.m. - 6 p.m.

www.vancouverfallhomeshow.com

October 21

Zac Brown Band Out in The Middle Tour

Rogers Arena

Grammy-award winning country rockers return to touring, 7 p.m.

https://zacbrownband.com

October 21-22

Elton John: Farewell Yellow Brick Road Final Tour

BC Place Stadium

Still touring after more than half a century, the rock-'n-roll icon takes the stage for the final concerts in Vancouver at 8 p.m.

www.destinationvancouver.com

October 29

Carly Rae Jepsen: So Nice Tour

Doug Mitchell Thunderbird Sports Centre

BC-born Juno Award winning artist returns home, 8 p.m.

thunderbirdarena.ubc.ca/carly-rae-jepsen

Until October 31

Fin-tastic Fall Days

Vancouver Aquarium, Stanley Park

Discover new spooky surprises; 10 a.m - 5 p.m. daily

www.vanaqua.org

Until October 31

HowlOver Canada

FlyOver Canada, Canada Place

A chance to soar from coast to coast with some spooky characters, all on your way to a haunted music festival

www.flyovercanada.com/halloween

Until October 31

Pumpkins After Dark

Central Park, Burnaby

A Halloween walk-through family event, complete with hundreds of carved Jack-O-Lanterns

pumpkinsafterdark.com

October 31

The Wiggles

Vancouver Playhouse, 600 Hamilton

Australian children’s entertainment group has thrilled kids everywhere for more than 30 years, at 3:30 p.m.

https://www.thewiggles.com

ONGOING EVENTS

Orpheum Theatre Walking Tours

884 Granville St., Vancouver

Free guided tours of the Orpheum Theatre, one of the most beautiful concert halls in North America

www.destinationvancouver.com

Forbidden Vancouver Walking Tours

Downtown Locations

Highly recommended, guided walking tours, a combination of storytelling, theatre and local history

forbiddenvancouver.ca

Until February 23, 2023

T. rex: The Ultimate Predator

Science World

A life-sized model of a Tyrannosaurus rex to captivate young and old, setting the stage for entertaining investigation into dinosaur history — daily from 10:00 a.m. (Covid-19 protocols in effect)

VanDusen Botanical Gardens

Vancouver

Enjoying the great outdoors in the heart of the city, family-friendly

vandusengarden.org

Sea to Sky Gondola

Squamish

Spectacular Sky Pilot suspension bridge walking trails, the Via Ferrata adventure and many other mountain-top activities

Vancouver

Enjoying the great outdoors in the heart of the city, family-friendly

vandusengarden.org

Sea to Sky Gondola

Squamish

Spectacular Sky Pilot suspension bridge walking trails, the Via Ferrata adventure and many other mountain-top activities

Vancouver Aquarium

Stanley Park

Over 65,000 animals under one roof, home of the only Marine Mammal Rescue Centre in Canada (mandatory face masks)

www.vanaqua.org

Over 65,000 animals under one roof, home of the only Marine Mammal Rescue Centre in Canada (mandatory face masks)

www.vanaqua.org

Bill Reid Gallery

A small but significant collection of art and archives related to Bill Reid and his legacy, with a majority of it (161 works in a variety of media from jewelry to prints and sculptures) from the Simon Fraser University Bill Reid Collection.

www.billreidgallery.ca

Worldwide Webcams

A website catering to people who want to travel, virtual visits everywhere with webcams from Argentina to Zanzibar, and many places in between

skylinewebcams.com

BC Sports Hall of Fame and Museum

Many of Canada’s most talented athletes at Indigenous Sport Gallery, Canadian Dragon Boat Exhibition, Greg Moore Gallery, Rick Hansen Gallery! Daily 9 a.m. to 5 p.m.

bcsportshall.com

Grouse Mountain — The Peak of Vancouver

Plenty of activities for all ages when purchasing a mountain admission ticket

www.tourismvancouver.com/listings/grouse-mountain-the-peak

Virtual Tours of 12 Famous Museums

Experiencing museums from London to Seoul from the comfort of your home

www.travelandleisure.com/attractions

North Shore Events

www.vancouversnorthshore.com/events-calendar/

West Vancouver United Church

Sunday service 10 a.m.

wvuc.bc.ca/worship/

Tourism Vancouver

Virtually Vancouver, and more

www.tourismvancouver.com

Need some culture or learning in your life?

Go to a virtual museum — you’ll find a lot of them through Google: artsandculture.google.com

Go to a virtual opera: www.metopera.org/

Visit the Science Centre: www.scienceworld.ca/

Nature web cams can be fun to watch. explore.org/livecams

Search for lots of free learning programs for kids and adults online.

Virtual programming at your favourite library

A small but significant collection of art and archives related to Bill Reid and his legacy, with a majority of it (161 works in a variety of media from jewelry to prints and sculptures) from the Simon Fraser University Bill Reid Collection.

www.billreidgallery.ca

Worldwide Webcams

A website catering to people who want to travel, virtual visits everywhere with webcams from Argentina to Zanzibar, and many places in between

skylinewebcams.com

BC Sports Hall of Fame and Museum

Many of Canada’s most talented athletes at Indigenous Sport Gallery, Canadian Dragon Boat Exhibition, Greg Moore Gallery, Rick Hansen Gallery! Daily 9 a.m. to 5 p.m.

bcsportshall.com

Grouse Mountain — The Peak of Vancouver

Plenty of activities for all ages when purchasing a mountain admission ticket

www.tourismvancouver.com/listings/grouse-mountain-the-peak

Virtual Tours of 12 Famous Museums

Experiencing museums from London to Seoul from the comfort of your home

www.travelandleisure.com/attractions

North Shore Events

www.vancouversnorthshore.com/events-calendar/

West Vancouver United Church

Sunday service 10 a.m.

wvuc.bc.ca/worship/

Tourism Vancouver

Virtually Vancouver, and more

www.tourismvancouver.com

Need some culture or learning in your life?

Go to a virtual museum — you’ll find a lot of them through Google: artsandculture.google.com

Go to a virtual opera: www.metopera.org/

Visit the Science Centre: www.scienceworld.ca/

Nature web cams can be fun to watch. explore.org/livecams

Search for lots of free learning programs for kids and adults online.

Virtual programming at your favourite library