IN THIS ISSUE

• Post-pandemic factors: immigration, seasonality

• Are capital gains tax, higher interest rates coming?

• Testimonial: ‘They helped us see what we couldn’t see'

• Property assessment just one tool for evaluating homes

Statistics door opener to real estate ‘new normal’

The new normal. That’s the indication from the monthly report for June, according to the Real Estate Board of Greater Vancouver statistics, and it opens the door to defining what “new normal” is.Another way of putting it is: Where is the market going? Before getting into the stats, it’s worth noting what factors are likely to affect real estate in the month(s) ahead, starting with July.

Immigration is always a factor, and perhaps a big one. Like many things, it was shut down by COVID-19, so a return to traditional immigration is imminent. There are others factors, which will be explored in more detail in next month’s issue of News From Nexus. If you’d like to discuss it before August, you can always call Jennifer or Dale for more, at 604-922-3353.

Immigration is always a factor, and perhaps a big one. Like many things, it was shut down by COVID-19, so a return to traditional immigration is imminent. There are others factors, which will be explored in more detail in next month’s issue of News From Nexus. If you’d like to discuss it before August, you can always call Jennifer or Dale for more, at 604-922-3353.Seasonality is another probable factor, because traditionally activity slows down during the summer months. However, this was an atypical June, with sales activity exceeding the 10-year average for the month.

Why?

In part, because the economy is starting to recover from the pandemic, and in part because the “new normal” is when people return to what was. That includes selling and perhaps buying homes now that sellers and buyers feel more comfortable — and safer — about moving on with their lives. While pre-June statistics indicated many homeowners were comfortable with the COVID market, obviously there were also many who weren't.

The June statistics synopsis was described as a “steady, calmer pace” than the hyper-activity of the spring. Metro Vancouver residential home sales jumped 54 per cent over June 2020 but dropped 11.9 per cent from May 2021.

REBGV economist Keith Stewart explained it this way:

“The past two months have shown a market that’s shifting toward more historically typical conditions. This is making multiple offers less common, allowing subjects to be seen on offers more frequently again, and is making new price records less likely.”

The up-from-June 2020 and down-from-May 2021 formula applied to detached homes, attached homes and apartments, the three categories tracked by the REBGV. And while that applied to sales, the benchmark prices remained stable or showed modest increases compared to the previous month (May 2021) in almost every category (“benchmark” represents a typical property in each market).

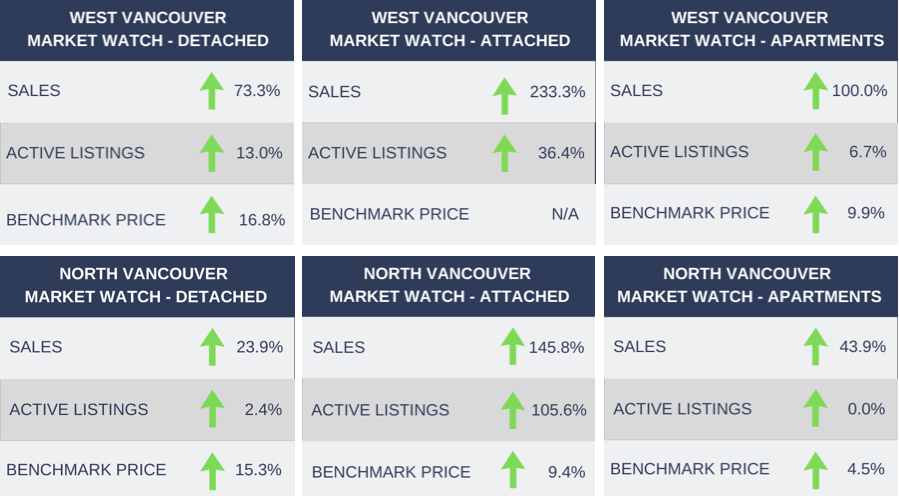

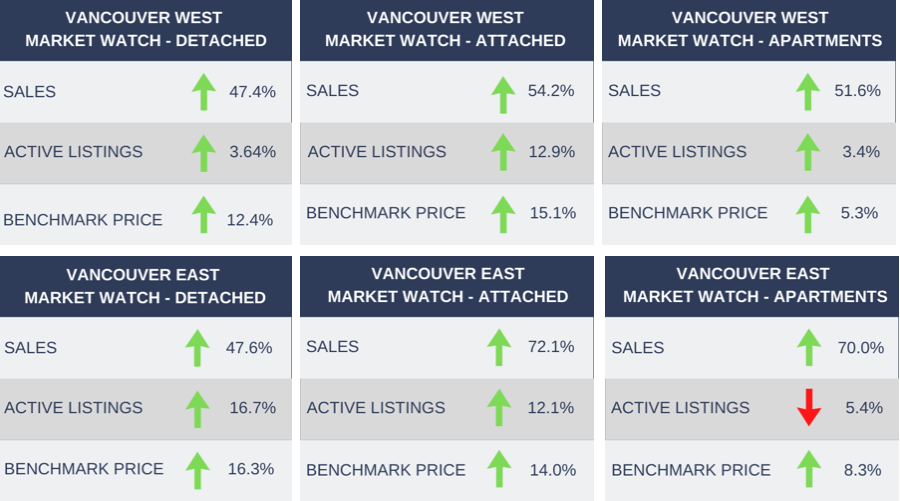

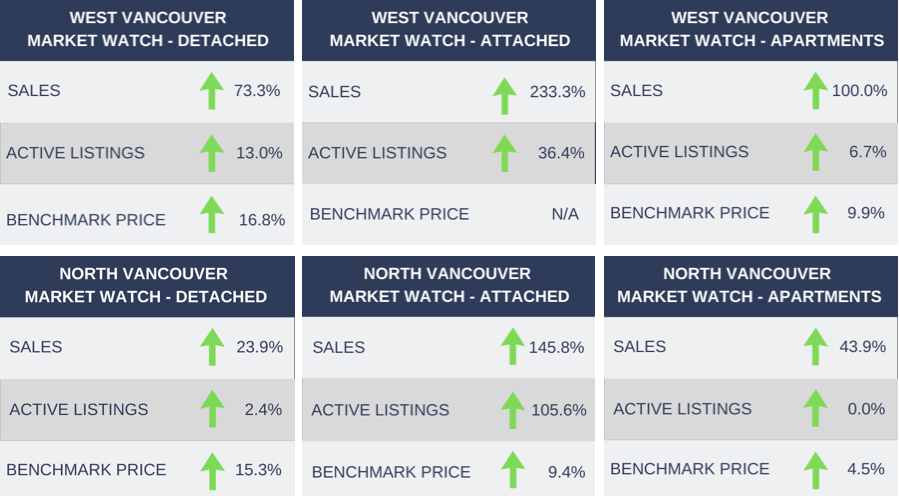

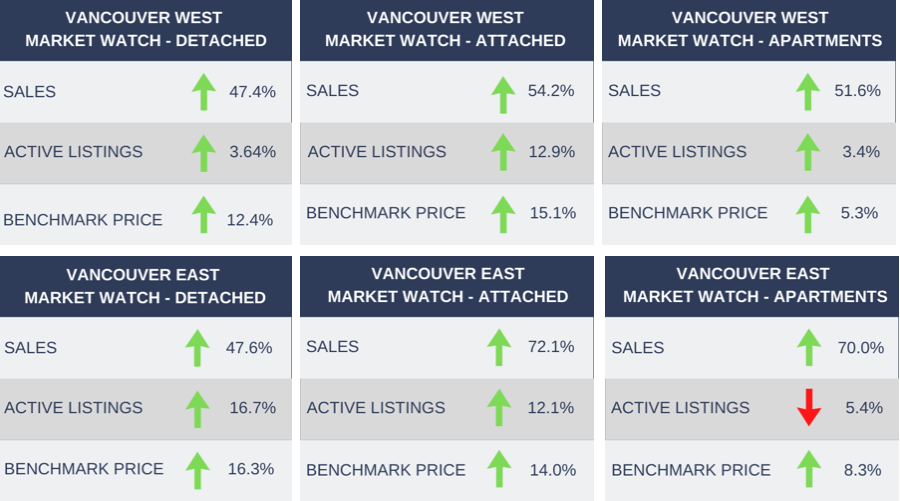

This is also true in the four markets that News From Nexus extracts for its primary clientele — West Vancouver, North Vancouver, Vancouver East and Vancouver West — as you will see from the statistical charts below.

In all, it’s begging to sound perfectly…well, normal.

A study to address the needs of housing a growing population from an expert panel appointed by the Federal and British Columbia governments was released in mid-June.

Curiously, it was missing even a mention of the possible introduction of a capital gains tax on housing profits, even though it’s something homeowners have long feared as a possibility to keep housing prices in line. That fear usually increases when house prices are on the rise — as a  solution for keeping housing affordable.

solution for keeping housing affordable.

solution for keeping housing affordable.

solution for keeping housing affordable.

The expert panel gave the governments five calls to action.

• Her business will be more visible and accessible on Pacific Avenue, in the heart of White Rock.

• Her business will be more visible and accessible on Pacific Avenue, in the heart of White Rock.

Until August 2

July 30-August 8

Until August 29

Until October 31

Ambleside Artisan Farmers’ Market, Ambleside Park

A great variety of organic and conventional farmers, every Sunday from 10 a.m. to 3 p.m.

Until October

Lonsdale Artisan Farmers' Market, Lonsdale Quay

Locally grown produce, delicious baked goods and crafts from local folks; every Saturday from 10 a.m. to 3 p.m.

www.artisanmarkets.ca/our-markets/lonsdale-quay-farmers-market

Until January 2

One, expedite the planning process for new housing. Two, reform the process for development-related charges and be transparent. Three, increase community and affordable housing construction. Four, better co-ordination or integration among all orders of government. And five, removal of preferential tax treatment for homeowners, including the B.C. Homeowner Grant.

The idea is to find a way to increase housing supply to meet the demand, and to address affordability. Among G7 countries, there’s an average of 471 dwellings for every 1,000 residents and Canada would need to add 1.8 million dwellings to reach that threshold, according to a story in The Financial Post.

The report will do nothing to quell the fears of a capital gains tax on real estate, and could prompt some homeowners to cash in the equity of their homes sooner rather than later by selling before a tax is levied.

Another financial elephant in the room for homeowners is what happens with the historically low interest rates that continue to have a positive impact on the real estate market. Now that COVID-19 appears to be on the decline and the government costs resulting from the pandemic must be paid, raising interest rates may seem an obvious answer.

However, Canada has a Triple-A credit rating and at least some economists seem to think handling that debt is within the range of affordability. Another positive for maintaining low interest rates is that Canada has an impressively low tax rate per gross domestic product.

The possibilities of a capital gains tax and an interest-rate bump can impact the real estate market.

Both bear watching.

"We sold our home [at the top of the market] and bought our condominium, which is absolutely perfect. We were reluctant to buy the condo but Dale and Jenn helped us see what it could become by showing us things that we simply couldn’t see ourselves — and they were right. The condominium is a perfect home for us."

— Mike and Carolyn Weiler, Vancouver

— Mike and Carolyn Weiler, Vancouver

June boon for two Nexus Realty clients

The buyer was a client, part of a family that had many years of experience with the “Nexus way” of pursuing real estate opportunities. She knew it was time for her framing and art supplies business in White Rock to change and one option was to transition from renting the space to owning it.

So transition she will.

When the purchase of a commercial property that matched her retail requirements with her business objective was negotiated in June, she is enthusiastically moving ahead because:

• Her business will be more visible and accessible on Pacific Avenue, in the heart of White Rock.

• Her business will be more visible and accessible on Pacific Avenue, in the heart of White Rock.

• She will now be walking distance from home.

• With a store that’s part of the Five Corners Shopping District, her business will have the benefit of pedestrian traffic that's more synergistic

• By occupying the new space, her business efficiency will increase.

• With the rising price of retail rent, the opportunity to become an owner is a big plus.

• In all, it's a happy change in quality of life.

All that was in addition to the financial part of the move. With Nexus working closely as part of her team effort, she was able to purchase this commercial property at a fair price, in what these days has been called a seller’s market.

Another Nexus client, this one a couple and a seller, also enjoyed a happy month. Their downtown Vancouver condo sold for an excellent price and generated lots of interest before the subjects were removed from a conditional offer.

The condo, at 999 Seymour Street, was on the market less than a week when the conditional offer was made. Its desirable location, bridging Vancouver’s entertainment district with Yaletown, was part of the reason the condo was a hot commodity. The photography, complemented by virtual staging, and the accurate and attractive descriptions of the property brought the seller and buyer together to negotiate the sale quickly.

For these two Nexus clients, the experiences made June a month to celebrate.

The interpretation of property assessments

One of the Nexus blogs in June reported that a judge’s ruling in B.C. Supreme Court could have an impact – in the view of the CBC’s story about it — on future valuations from the Property Assessment Review Panel (PARP). The decision has to do with challenging PARP's valuation of property through appeal, and the complete story is here on the CBC’s website. If a property assessment can be decreased, the homeowner pays less taxes and the homeowner who’s selling can anticipate that home may be viewed as being less valuable. On the other hand, some owners want their assessed value to go higher because they're selling and a higher assessment could mean a higher selling price.

But there’s a bigger picture that puts it in perspective.

Property assessments are not always accurate in determining what a house is worth. Properties are assessed by July 1 each year. Assessments  come out around the following January 1. So by the time homeowners receive them, the assessments are already six months old. In addition, the next assessment after that won't be known for one year. That means, for example, that a property assessment done in July 2021 won't be changed and be public until January 2023. Until that date, the "assessed value" could be as much as 18 months old. Who knows how much house prices can fluctuate in that time?

come out around the following January 1. So by the time homeowners receive them, the assessments are already six months old. In addition, the next assessment after that won't be known for one year. That means, for example, that a property assessment done in July 2021 won't be changed and be public until January 2023. Until that date, the "assessed value" could be as much as 18 months old. Who knows how much house prices can fluctuate in that time?

come out around the following January 1. So by the time homeowners receive them, the assessments are already six months old. In addition, the next assessment after that won't be known for one year. That means, for example, that a property assessment done in July 2021 won't be changed and be public until January 2023. Until that date, the "assessed value" could be as much as 18 months old. Who knows how much house prices can fluctuate in that time?

come out around the following January 1. So by the time homeowners receive them, the assessments are already six months old. In addition, the next assessment after that won't be known for one year. That means, for example, that a property assessment done in July 2021 won't be changed and be public until January 2023. Until that date, the "assessed value" could be as much as 18 months old. Who knows how much house prices can fluctuate in that time?

So while assessment is useful in calculating property values, it is only one part of the conversation…one indicator. Among the others are market conditions. What has happened to the real estate market in general since the property assessment was completed on July 1? What has happened to the neighbourhood, or micro-markets? And where are those markets going, or where are they likely to go?

What renovations have been done to the property? Homeowners may constantly be making substantial improvements that perhaps assessors don't take into consideration when doing their calculations — such as flooring, modernizing kitchens or bathrooms and other such non-structural renovations that genuinely increase the value of their home.

It's always possible, of course, that something has happened to decrease the property's value since the assessment was done.

And if you market a property on its assessed value only by saying it's “priced below assessment” you are marketing it on potential, because nobody knows with certainty where the market is going after the assessor's analysis is complete.

The Nexus experience is that a lot goes into determining a home’s value. Often the first sentence a realtor will hear — from either a seller or a buyer — is about basing the price primarily on its assessed value. There's so much more to analyze, and that’s why it’s important to capitalize on the more complete knowledge that Jennifer and Dale have to offer, to get a true picture of what a property is worth.

No matter what impact the Supreme Court justice’s decision has on property assessments.

That in the extreme heat of this summer, backyard pools are regarded in some markets as a selling feature even though pools have often been seen as a negative for — among other reasons — increasing a property’s value by no more than seven per cent, according to real estate “experts”?

Real Estate Monthly Statistics

The following statistics for West Vancouver, North Vancouver, Vancouver West and Vancouver East compare June 2021 to June 2020

(note: sales refers to number of sales, not to sale prices).

Benchmark Price: Estimated sale price of a benchmark property. Benchmarks represent a typical property within each market.

To see more information on local stats, please click here.

This month's calendar includes more in-person, outdoor events and they are unique, because of the COVID world in which they are being staged. The fact there are more is a good sign but it's important to pay attention to the protocols that come with them. Here is this month's list, along with links to where you can find out what's required where applicable:

July 1-24Carnaval del Sol

One of the most popular and fun annual festivals taking place in Vancouver every July, attracting Latin America culture fans with live music, dance, sports, art and poetry

www.rove.me/to/vancouver/carnaval-del-sol

July 8-17

One of the most popular and fun annual festivals taking place in Vancouver every July, attracting Latin America culture fans with live music, dance, sports, art and poetry

www.rove.me/to/vancouver/carnaval-del-sol

July 8-17

Dancing on the Edge Festival

In celebration of the 33rd annual festival, a presentation of over 30 online and live stage performances featuring artists from across Canada

www.dancingontheedge.org

In celebration of the 33rd annual festival, a presentation of over 30 online and live stage performances featuring artists from across Canada

www.dancingontheedge.org

Until August 2

Museum of Vancouver

In partnership with Haida Gwaii Museum, a visual feast of innovation and tradition, Haida Now — featuring an unparalleled collection of Haida art, with more than 450 works

museumofvancouver

In partnership with Haida Gwaii Museum, a visual feast of innovation and tradition, Haida Now — featuring an unparalleled collection of Haida art, with more than 450 works

museumofvancouver

July 30-August 8

Harmony Arts Festival

A different look, yet with the spirit, lifestyle and natural beauty that makes West Vancouver so special

www.harmonyarts.ca

A different look, yet with the spirit, lifestyle and natural beauty that makes West Vancouver so special

www.harmonyarts.ca

Until August 29

Imagine Van Gogh

Dozens of the Dutch artist’s painting in the travelling art exhibition at the Vancouver Convention Centre

vancouversbestplaces.com/vancouver-art-exhibition

Dozens of the Dutch artist’s painting in the travelling art exhibition at the Vancouver Convention Centre

vancouversbestplaces.com/vancouver-art-exhibition

Until October 31

Ambleside Artisan Farmers’ Market, Ambleside Park

A great variety of organic and conventional farmers, every Sunday from 10 a.m. to 3 p.m.

Until October

Lonsdale Artisan Farmers' Market, Lonsdale Quay

Locally grown produce, delicious baked goods and crafts from local folks; every Saturday from 10 a.m. to 3 p.m.

www.artisanmarkets.ca/our-markets/lonsdale-quay-farmers-market

Until January 2

Vancouver Art Gallery

Vancouver Special: Disorientations and Echo — The second in a series of exhibitions, this one with a primary emphasis on recent works that hold a particular resonance for this time and place not been previously exhibited in Vancouver

www.vanartgallery.bc.ca

Sea To Sky Gondola

Now open with its new cars, daily 9 a.m. to 4 p.m.

www.seatoskygondola.com

Buckingham Palace

A virtual tour of the official residence of Queen Elizabeth, the focus of many moments of national celebration — jubilees, weddings, VE Day and the annual Trooping the Colour on The Queen's official birthday

www.royal.uk/virtual-tours-buckingham-palace

Capilano Suspension Bridge

Appreciating nature from three breathtaking perspectives — Capilano Suspension Bridge, Treetops Adventure and the exciting new Cliffwalk

www.tourismvancouver.com/listings/capilano-suspension-bridge-park

BC Sports Hall of Fame and Museum

bcsportshall.com

Britannia Mine Museum

Little-seen world that fascinates all ages with awe-inspiring sights and memorable family experiences

www.tourismvancouver.com/listings/britannia-mine-museum

Grouse Mountain, The Peak of Vancouver

Advance reservations for your Skyride boarding time mandatory, when purchasing tickets online

www.tourismvancouver.com/listings/grouse-mountain-the-peak

Virtual Tours of 12 Famous Museums

Experiencing museums from London to Seoul from the comfort of your home

www.travelandleisure.com/attractions

North Shore Events

www.vancouversnorthshore.com/events-calendar/

West Vancouver United Church

Sunday service 10 a.m.

wvuc.bc.ca/worship/

Tourism Vancouver

Virtually Vancouver, and more

www.tourismvancouver.com

Need some culture or learning in your life?

Go to a virtual museum: find a lot of them through Google: artsandculture.google.com

Go to a virtual opera: www.metopera.org/

Visit the Science Centre: www.scienceworld.ca/

Nature web cams can be fun to watch.: explore.org/livecams

Search for lots of free learning programs for kids and adults online.

Virtual programming at your favourite library

westvanlibrary.ca/

nvcl.ca/

nvdpl.ca/

vpl.ca/digitallibrary

www.vanartgallery.bc.ca

Sea To Sky Gondola

Now open with its new cars, daily 9 a.m. to 4 p.m.

www.seatoskygondola.com

Buckingham Palace

A virtual tour of the official residence of Queen Elizabeth, the focus of many moments of national celebration — jubilees, weddings, VE Day and the annual Trooping the Colour on The Queen's official birthday

www.royal.uk/virtual-tours-buckingham-palace

Capilano Suspension Bridge

Appreciating nature from three breathtaking perspectives — Capilano Suspension Bridge, Treetops Adventure and the exciting new Cliffwalk

www.tourismvancouver.com/listings/capilano-suspension-bridge-park

BC Sports Hall of Fame and Museum

bcsportshall.com

Britannia Mine Museum

Little-seen world that fascinates all ages with awe-inspiring sights and memorable family experiences

www.tourismvancouver.com/listings/britannia-mine-museum

Grouse Mountain, The Peak of Vancouver

Advance reservations for your Skyride boarding time mandatory, when purchasing tickets online

www.tourismvancouver.com/listings/grouse-mountain-the-peak

Virtual Tours of 12 Famous Museums

Experiencing museums from London to Seoul from the comfort of your home

www.travelandleisure.com/attractions

North Shore Events

www.vancouversnorthshore.com/events-calendar/

West Vancouver United Church

Sunday service 10 a.m.

wvuc.bc.ca/worship/

Tourism Vancouver

Virtually Vancouver, and more

www.tourismvancouver.com

Need some culture or learning in your life?

Go to a virtual museum: find a lot of them through Google: artsandculture.google.com

Go to a virtual opera: www.metopera.org/

Visit the Science Centre: www.scienceworld.ca/

Nature web cams can be fun to watch.: explore.org/livecams

Search for lots of free learning programs for kids and adults online.

Virtual programming at your favourite library

westvanlibrary.ca/

nvcl.ca/

nvdpl.ca/

vpl.ca/digitallibrary