IN THIS ISSUE:

• Headlines regarding housing from federal budget

• Thoughts on dealing with the shortage of homes

• Fast sale for one of two similar Nexus properties

• Watching cruise ships from shores of Burrard Inlet

• Decor: The many varieties of flooring

Snapshot of federal budget housing component

The wait is over. The Federal Government addressed its plan for dealing with home prices and affordable housing when it announced Budget 2022. Its impact is going to be significant, to say the least

.

Over the next five years, the government will invest billions of dollars on housing affordability.

These are the headlines…

CONSTRUCTION: Building of new homes will double over the next decade.

HOUSING ACCELERATOR FUND: Launched with $4 billion, this fund is designed to help municipalities speed up the development of new housing.

FIRST-TIME BUYERS: A tax-free savings account will be available, much like the established TFSA.

FOREIGN BUYERS: Non-Canadian citizens will be prohibited from purchasing property for two years.

QUICK PROFITS: Buying and selling a home in less than 12 months (sometimes described as “flipping”) will be subject to full taxation on the profits.

BILL OF RIGHTS: One will be drafted for home buyers.

HOUSING HELP: This will be available for Indigenous and the most vulnerable people.

Sauder School of Business housing expert Tsur Somerville told Global News that housing expectations from the budget must be tempered.

“The money does not turn into action very, very quickly,” he said. “Yeah, money is good, but this is not a game-changer. It is a cup of water in a lake.”

In the final analysis, it will be the results that tell the true story of the budget’s impact on real estate, and that’s certain to take time.

Watch for updates in the days ahead, available here at nexusrealty.com.

Viewpoints on addressing the housing shortage

Viewpoints on addressing the housing shortage

There’s a number of thoughts involved in the discussions about who decides what when it comes to building homes to accommodate the Lower Mainland’s housing shortage. Ever since Housing Minister David Eby said the B.C. Government may get involved in speeding up housing developments, it has become a hot topic among municipal officials, builders, realtors and home owners.

The shortage is putting pressure on home prices, where people are currently going to live and the impending growth of immigration in the months and years ahead.

Here is what the Housing Minister said a little over a month ago:

“Cities should have the right to say where housing needs to go, what is a priority heritage area and where they want growth, but they shouldn’t be allowed to decide whether or not the housing goes ahead, which is currently where we are. We’re going to have to ultimately prescribe some minimum standards for municipalities…we hope to introduce some legislation on this.”

Here is what the Union of B.C. Municipalities says:

“Data from Statistics Canada…show the number of houses being completed in B.C. closely matches our population growth. Statistics show too much new housing construction is investor-driven and that is contributing to high prices for anyone trying to get into the housing market.”

Here is what The Home Builders Association of British Columbia says:

“Against undeniable, mounting evidence of housing supply shortages, opinions from industry experts, and concerted action from higher levels of government to build more supply — UBCM stands alone in their position. While B.C. has done well in recent years by meeting the challenge of increasing supply with higher numbers of registered homes and housing starts, there are decades of supply shortages to make up for as we face a peak immigration period. Addressing the supply has been dismissed for far too long, and demand for housing is here to stay.”

Here is what Bryn Davidson, whose company has built the most laneway homes in Vancouver to address the housing shortage, says:

“Number one is getting rid of the separate development permit process for any single-lot residential project. No more neighbour notification or having to do material boards…we can cut eight months out of the project without changing anything. It’s an easy win. The second bit is we need housing options throughout the city that are actually more accessible to the typical person. That means allowing stratification or subdivision of big lots.”

And here is what Scotiabank, looking at it from a national perspective, says:

“Canada has a structural housing shortage. This is by now very well established…we would need an additional 1.8 million dwellings in Canada to have the same number of homes per capita as other G7 countries…the shortage of housing relative to the population’s needs will continue to put upward pressure on prices and rents and reduce affordability. Much remains to be done by policymakers to help close the housing deficit. There are encouraging signs…housing starts are running well above pre-pandemic levels, though that is unlikely to meaningfully close the gap between supply and demand anytime soon and [there’s] an expectation of strong immigration growth.”

With so many different perspectives, it will make the process interesting.

Two listings, two great offerings, one quickly sold

A real find. Rarely available. Near the beach. Best location. Great offering.

A real find. Rarely available. Near the beach. Best location. Great offering.

Those flattering descriptors can refer to many properties on the market, of course, and many realtors have used them for a specific listing. As it happens, Nexus Realty can apply them to two listings, one of which sold in days.

One is in White Rock. The other — now sold — is in West Vancouver. Both were new on the market. Both are on quiet cul-de-sacs. Both are close to all the neighbourhood amenities. As much as they share these attributes, they are as different as the beaches that they access.

The White Rock listing is 891 – 165 Street. It has 2,500 square feet on a property of 7,365 square feet, and has four bedrooms plus a den, plus a rec room, plus a beautiful kitchen with granite counters, plus a double garage, plus many extras that make it a beautiful family home in a seaside community.

The beach and the famous White Rock Pier are minutes away, and attractive for all residents of South Surrey, as are the shops, golf courses and access to the U.S. border, with Highway 99 nearby.

At $1,698,000 million, it is a great offering.

The West Vancouver listing is 1752 Duchess Avenue. It was a “real find” that's “rarely available.” That’s because it’s a townhome at the end of a cul-de-sac, in a property zoned for high rise yet one of only four townhomes in a pet-friendly, rental-friendly building. In a highly desirable area, it can be either a family home or one that includes in-laws or students or just overnight guests.

The West Vancouver listing is 1752 Duchess Avenue. It was a “real find” that's “rarely available.” That’s because it’s a townhome at the end of a cul-de-sac, in a property zoned for high rise yet one of only four townhomes in a pet-friendly, rental-friendly building. In a highly desirable area, it can be either a family home or one that includes in-laws or students or just overnight guests.

In addition to its location and proximity to the beach (Ambleside), its main floor is beautifully renovated with an open-plan kitchen, plus dining and living rooms that open onto south-facing deck. It has been upgraded with new windows throughout and new flooring. All three levels have patios or decks with southern exposure, it also has a wood-burning fireplace and low maintenance fees.

Described as a “picture-perfect townhome," opportunities like this come along only periodically and generally attract a lot of interest for obvious reasons, and this one did.

It was also a great offering, at $1,688,000.

North Shore to Alberta move made easy

After many years in West Vancouver, Don and Shirley McPhee decided to move closer to family and relocated in Red Deer, Alberta. That meant selling their condominium and Nexus Realty happily made it as easy for them as possible.

The McPhees were so happy that they wanted to share their experience with other Nexus customers and newsletter readers:

"Dale and Jennifer recently provided a friendly and completely competent and professional brokerage service for us in the sale of our West Vancouver condominium. We knew them from the church, and were so comfortable working with them. It was such an easy decision to have them handle the sale of our condominium. It’s always comforting to deal with someone you know.

"Dale and Jennifer recently provided a friendly and completely competent and professional brokerage service for us in the sale of our West Vancouver condominium. We knew them from the church, and were so comfortable working with them. It was such an easy decision to have them handle the sale of our condominium. It’s always comforting to deal with someone you know.

"Our sons were very impressed with Jennifer and Dale. They are so professional, so competent and so friendly. All three of those qualities are important. Everyone just got along so well. They relieved all the stress and pressure of selling.

"We were so happy with the whole process. Dale and Jennifer even found a company to help us decide what to dispose of and what to move. We left a lot of that up to the company. It was an invaluable service to a couple of elderly folks who would have been swamped with the details of preparing for a move. And when we ran into a small problem, Dale and Jennifer helped us out of it to the benefit of all concerned.

"We would highly recommend the services of Nexus Realty to anybody in the Vancouver region."

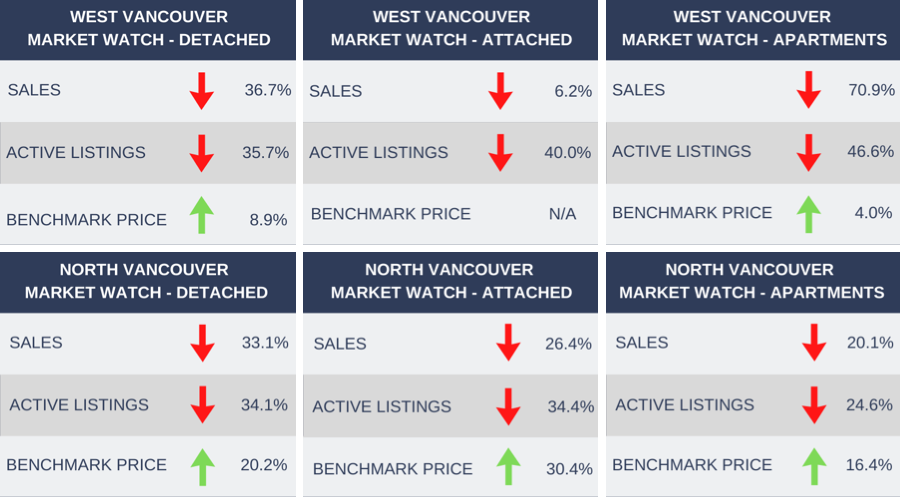

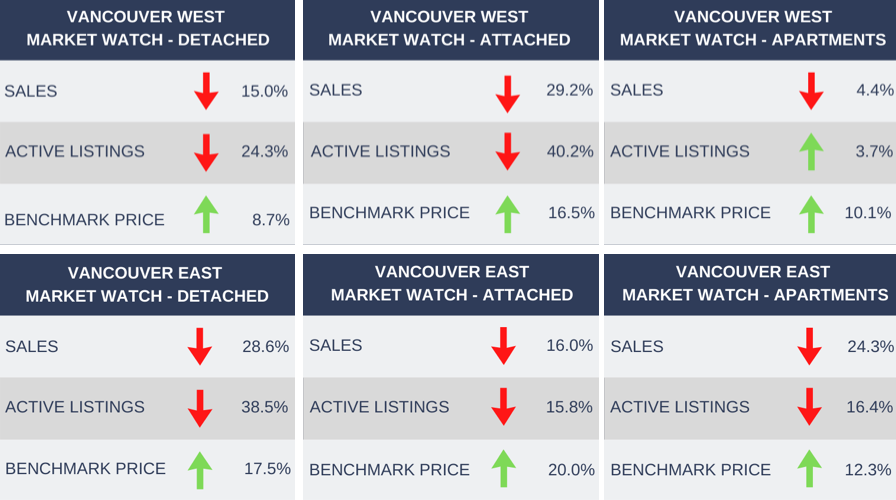

Micro-markets: statistics sometimes differ

The news from the Real Estate Board of Greater Vancouver this month is pretty much unchanged from last month. Sales above average. Listings too low. Home prices on the rise.

However, it’s often interesting to dig deeper when analyzing statistics. That being the case, for the four districts that get most of the attention from Nexus Realty (West Vancouver, North Vancouver, Vancouver West, Vancouver East), there are some surprising tidbits of information in the latest REBGV statistics.

In North Vancouver, in March there were 32 more detached homes listed than in February…plus 21 more townhomes and 30 more apartments. Cumulatively, that’s an increase of 84 more listings in March than the previous month, and there were 75 more sales as well.

In North Vancouver, in March there were 32 more detached homes listed than in February…plus 21 more townhomes and 30 more apartments. Cumulatively, that’s an increase of 84 more listings in March than the previous month, and there were 75 more sales as well.

In West Vancouver, there were more townhome sales (15) than there were new listings (12) in March, and a sales increase of almost 400 per cent from March 2021.

In Vancouver West, there were more apartments listed (958) this March than last March (923) and 199 more than in February 2022.

In Vancouver East, sales (134) exceeded new listings (92) in all three categories in March, and more townhomes were sold (28) than in the same month a year ago (15).

So while the REBGV’s statistics paint the picture for all of Metro Vancouver, it can differ from some of the niche markets or micro-markets, like the ones most familiar to Nexus Realty clients. For example, REBGV discovered that sales last month dropped 23.9 per cent from March 2021, which was the highest selling month in the organization’s 102-year history, but is still 25.5 per cent above the 10-year average for March.

“This year’s activity is happening at a calmer pace than we experienced 12 months ago,” said the REBGV in its monthly news release. “Home buyers are keeping a close eye on rising interest rates, hoping to make a move before their locked-in rates expire.”

The Bank of Canada is expected to raise interest rates this month, which could spark a rise in new listings. The real estate board framed the housing need like this:

“The number of homes listed for sale on our MLS® system today is less than half of what’s needed to shift the market into balanced territory. We’re still seeing upward pressure on prices across all housing categories in the region. Lack of supply is driving this pressure.”

And market conditions, whatever they may be, always have added clarity in the spring market.

View properties: the return of the cruise ships

View properties: the return of the cruise ships

For the first time in close to 900 days, residents on both sides of Burrard Inlet will be watching cruise ships come and go, under the Lions Gate Bridge and into the Port of Vancouver, which hasn’t had visitors like this since the COVID-19 began.

The cruise season in Vancouver really picks up towards the end of April and the ships will go full steam ahead, pandemic permitting, until autumn. They have been missed. Estimates are that each cruise ship stopping in Vancouver means $3 million for the local economy.

The schedules are a little different. Research shows that not all ships have cruises that end and begin in Vancouver. Some cruises originate in Vancouver to another destination. Some originate in another destination and end in Vancouver, with no scheduled departure after that.

Also, in the climate that has existed since March 2020, everything is subject to date and time changes, and that includes cruises.

What’s in the news this month

B.C. ‘cooling off period’ bill tabled for decision by summer:

The provincial government introduced legislation that, if passed, will allow a “cooling off period” to protect home buyers by giving them more time to consider their offers, solidify financing and get a home inspection, while both the length of the cooling off period and the financial costs of retracting an offer will be determined when the legislation is finalized sometime this summer.

West Van properties moving quickly compared to 2021:

There were some dramatic changes in the number of days West Vancouver attached homes stayed on the market in the first two months of 2021 versus 2022: townhomes went from 94 days in January 2021 to just 3 days in January 2022, and in February from 50 days (2021) to 8 days (2022) while condos went from 107 days to 29 in January and 40 days to 20 in February.Proximity to land use and its impact on real estate prices:

A study published recently in Real Estate Economics found that dwellings within 100 metres of a cannabis dispensary in Vancouver sold for 3.8 per cent less than comparable properties farther away, unlike two studies in Colorado that found proximity to cannabis stores had a positive impact on the value of real estate (the Vancouver study was based on sales from 2005 to 2015).

Decor: Many ways for home owners to be ‘floored’

Seventh in a Series

Every month, News From Nexus features ideas or observations about Decor, or ways you can make your home more appealing.

For floor finishings, it’s only a few years ago that wall-to-wall carpet was the gold standard. Now, with so many newer types of flooring, carpet has become less desirable, and less popular. Cost and the level of care it requires have been powerful influences.

Having said that, there’s still something special about the feel of soft, warm carpet in bedrooms, and still other positives about having it wall-to-wall: reduced noise (most appreciated by occupants living beneath a carpeted room) and while quality underlay helps with sound absorption, it also eases pressure on feet.

Laminate flooring was invented in Sweden in the 1970s, but didn’t become popular in North America for almost two decades. It came with a somewhat negative connotation, which has been largely eliminated because modern technology has created better quality laminate and a seemingly endless array of styles and colours.

It’s relatively easy to install, even for modest do-it-yourselfers, and it’s stain and fade resistant, easy to care for and durable. The only real downside is when laminate flooring is water damaged it almost certainly needs to be replaced.

Hardwood floors are among the most durable, and pricier.There are stories about people who have purchased an older home with carpet throughout, ripping it up and discovering beautiful hardwood floors underneath. While the initial cost is higher, hardwood can last for generations, and is readily refinished. There are many types of hardwoods — with oak, cherry, maple and walnut among the most common. While hardwood flooring may not be regarded as water-resistant, engineered hardwood can be a waterproof flooring option if it is sealed correctly. The planks are constructed with a plywood base and topped with a strip of hardwood. It is available in various styles to replicate the classic look of many natural hardwoods at a more affordable price.

Bamboo, while not a tree, is like hardwood: hard and durable, and a natural and renewable product. It can also be refinished, and is easy to maintain but can scratch easily.

Cork is another natural, eco-friendly floor that’s among the easiest for walking comfort with its soft, cushioned surface. A good insulator that can be refinished, it does require a sealant for moisture protection. The only real negative with cork is that it is easier to damage, and furniture may leave indents.

Ceramic tile is arguably the most durable and versatile flooring. It’s commonly used for bathrooms, and more recently kitchens and playrooms. With high durability and easy maintenance, tile is a natural for entranceways or foyers and the colours, sizes and qualities are endless.

That, in 2021, almost 667,000 properties were sold in Canada and — according to the National Bank of Canada — it was an all-time record?

Photo credit: Decor flooring: Steven Ungermann, Unsplash

891 165 Street

White Rock, South Surrey

$1,698,000

Real Estate Monthly Statistics

The following statistics for West Vancouver, North Vancouver, Vancouver West and Vancouver East compare March 2022 to March 2021

(note: sales refers to number of sales, not to sale prices).

(note: sales refers to number of sales, not to sale prices).

Benchmark Price: Estimated sale price of a benchmark property. Benchmarks represent a typical property within each market.

To see more information on local stats, please click here.

What's happening in April throughout the Lower Mainland, with protocols included as currently known.

On now

The Great Salmon Run 4D Experience

Vancouver Aquarium

Vancouver Aquarium

Stanley Park

Based on one of Mother Nature’s most amazing events; 10 a.m - 5 p.m. daily (Covid-19 protocols in effect)

Vancouver Canucks at Rogers Arena

April 9: vs San Jose Sharks, 7 p.m.

April 12: vs Vegas Golden Knights, 7 p.m.

April 14: vs Arizona Coyotes, 7 p.m.

April 18: vs Dallas Stars, 7:30 p.m.

April 19: vs Ottawa Senators, 7 p.m.

April 26: vs Seattle Kraken, 7 p.m.

April 28: vs Los Angeles Kings, 7 p.m.

Abbotsford Canucks at Abbotsford Centre

April 9: vs San Diego Gulls, 7 p.m.

April 9: vs San Diego Gulls, 7 p.m.

April 10-14

TED2022: A New Era

Vancouver Convention Centre

Eleven sessions of TED’s famous talks, plus performances, activities, interviews and excursions with a world-class line-up that includes Bill Gates, Al Gore, Elon Musk (Covid-19 protocols in effect)

April 13 - August 31

Stargazer: An immersive experience in Outer Space

Tsawwassen Mills Shopping Mall

A journey through the stars and into deep space for all ages, with astonishing 270º wall and floor projections; curated in part by the MacMillan Space Centre

Until April 15

Gulf of Georgia Cannery — Waves of Innovation: Stories from the West Coast

An exhibit featuring stories of adaptations and innovations in the commercial fishing industry and their effects on west coast communities, with four key areas highlighted — energy, fishing, preservation and innovations of today

April 15-16

Billie Jean King Cup: Team Canada vs Team Latvia Tennis

Pacific Coliseum

Canada and Latvia head-to-head for the first time, with winner going to the finals in November (Covid-19 protocols in effect)

April 16-17

World Rugby Sevens

BC Place, Vancouver

The Rugby world's return to Vancouver, with men’s and women’s teams from 15 countries (Covid-19 protocols in effect)

Until April 18

Winter Vallea Lumina, Whistler

An evening excursion filled with unexpected enchantment, cryptic radio transmission and the lingering traces of two long-ago hikers in search of the scenic trailhead where the real journey begins

Until April 18

FlyOver Canada: FlyOver Iceland

Picturesque scenery, massive glaciers and spectacular Icelandic fjords, daily from 10 a.m-9 p.m. (proof of vaccination required); purchase tickets online in advance

April 22-24

VSO: Harry Potter and the Deathly Hallows

Orpheum Theatre, Vancouver

The full feature-length film accompanied by a live symphony orchestra

April 24

Vancouver Sun Run 10K

Downtown Vancouver

Canada’s largest 10K run on a scenic course through the city; race start 9 a.m.

April 30 - May 8

Vancouver Opera, HMS Pinafore

Queen Elizabeth Theatre, Vancouver

Gilbert and Sullivan’s wildly popular comedic tale delivering a memorable experience

Until May 1

Alegria, Cirque du Soleil

Under the Big Top, Concord Pacific Place

An iconic Cirque production with acrobatics, costumes, vibrant sets, all told with delightful humour

www.destinationvancouver.com/event/cirque-du-soleil

www.destinationvancouver.com/event/cirque-du-soleil

Until May 1

Yoko Ono: Growing Freedom

Vancouver Art Gallery

A two-part exhibit that focuses on her instructional work, and a second display of projects for peace, undertaken by Yoko Ono and John Lennon (proof of vaccination required)

www.vanartgallery.bc.ca

www.vanartgallery.bc.ca

Until October

Boarder X

Museum of Vancouver

A travelling exhibit that features work by contemporary artists from Indigenous nations across Canada (proof of vaccination required)

https://museumofvancouver.ca

https://museumofvancouver.ca

Until February 23, 2023

T. rex: The Ultimate Predator

Science World

A life-sized model of a Tyrannosaurus rex to captivate young and old, setting the stage for entertaining investigation into dinosaur history — daily from 10:00 a.m. (Covid-19 protocols in effect)

Bill Reid Gallery

A small but significant collection of art and archives related to Bill Reid and his legacy, with a majority of it (161 works in a variety of media from jewelry to prints and sculptures) from the Simon Fraser University Bill Reid Collection.

www.billreidgallery.ca

Worldwide Webcams

A website catering to people who miss travel, visiting virtually everywhere with webcams from Argentina to Zanzibar, and many places in between

skylinewebcams.com

Buckingham Palace

A virtual tour of the official residence of Queen Elizabeth, the focus of many moments of national celebration — jubilees, weddings, VE Day and the annual Trooping the Colour on The Queen's official birthday

www.royal.uk/virtual-tours-buckingham-palace

BC Sports Hall of Fame and Museum

Many of Canada’s most talented athletes at Indigenous Sport Gallery, Canadian Dragon Boat Exhibition, Greg Moore Gallery, Rick Hansen Gallery! Daily 9 a.m. to 5 p.m.

bcsportshall.com

Britannia Mine Museum — BOOM!

An award-winning live action attraction inside the historic mine

www.tourismvancouver.com/listings/britannia-mine-museum

Sea to Sky Gondola — Squamish

A breathtaking gondola ride to the summit to experience the Sky Pilot Suspension Bridge, three spectacular viewing platforms, snowshoeing, walking and hiking trails, with dining and shopping experiences at both ends of the ride; 9:30 p.m. to 5:00 p.m. daily

www.seatoskygondola.com

Grouse Mountain — The Peak of Vancouver

Plenty of activities for all ages when purchasing a mountain admission ticket

www.tourismvancouver.com/listings/grouse-mountain-the-peak

Virtual Tours of 12 Famous Museums

Experiencing museums from London to Seoul from the comfort of your home

www.travelandleisure.com/attractions

North Shore Events

www.vancouversnorthshore.com/events-calendar/

West Vancouver United Church

Sunday service 10 a.m.

wvuc.bc.ca/worship/

Tourism Vancouver

Virtually Vancouver, and more

www.tourismvancouver.com

Need some culture or learning in your life?

Go to a virtual museum — you’ll find a lot of them through Google: artsandculture.google.com

Go to a virtual opera: www.metopera.org/

Visit the Science Centre: www.scienceworld.ca/

Nature web cams can be fun to watch. explore.org/livecams

Search for lots of free learning programs for kids and adults online.

Virtual programming at your favourite library

A small but significant collection of art and archives related to Bill Reid and his legacy, with a majority of it (161 works in a variety of media from jewelry to prints and sculptures) from the Simon Fraser University Bill Reid Collection.

www.billreidgallery.ca

Worldwide Webcams

A website catering to people who miss travel, visiting virtually everywhere with webcams from Argentina to Zanzibar, and many places in between

skylinewebcams.com

Buckingham Palace

A virtual tour of the official residence of Queen Elizabeth, the focus of many moments of national celebration — jubilees, weddings, VE Day and the annual Trooping the Colour on The Queen's official birthday

www.royal.uk/virtual-tours-buckingham-palace

BC Sports Hall of Fame and Museum

Many of Canada’s most talented athletes at Indigenous Sport Gallery, Canadian Dragon Boat Exhibition, Greg Moore Gallery, Rick Hansen Gallery! Daily 9 a.m. to 5 p.m.

bcsportshall.com

Britannia Mine Museum — BOOM!

An award-winning live action attraction inside the historic mine

www.tourismvancouver.com/listings/britannia-mine-museum

Sea to Sky Gondola — Squamish

A breathtaking gondola ride to the summit to experience the Sky Pilot Suspension Bridge, three spectacular viewing platforms, snowshoeing, walking and hiking trails, with dining and shopping experiences at both ends of the ride; 9:30 p.m. to 5:00 p.m. daily

www.seatoskygondola.com

Grouse Mountain — The Peak of Vancouver

Plenty of activities for all ages when purchasing a mountain admission ticket

www.tourismvancouver.com/listings/grouse-mountain-the-peak

Virtual Tours of 12 Famous Museums

Experiencing museums from London to Seoul from the comfort of your home

www.travelandleisure.com/attractions

North Shore Events

www.vancouversnorthshore.com/events-calendar/

West Vancouver United Church

Sunday service 10 a.m.

wvuc.bc.ca/worship/

Tourism Vancouver

Virtually Vancouver, and more

www.tourismvancouver.com

Need some culture or learning in your life?

Go to a virtual museum — you’ll find a lot of them through Google: artsandculture.google.com

Go to a virtual opera: www.metopera.org/

Visit the Science Centre: www.scienceworld.ca/

Nature web cams can be fun to watch. explore.org/livecams

Search for lots of free learning programs for kids and adults online.

Virtual programming at your favourite library