IN THE MARCH ISSUE:

• How will interest-rate cut impact real estate? • Investing in the 2020s: the uniqueness of Vancouver

• Why the spring market shouldn't fool you • Vancouver’s three most searched neighbourhood

Big news: Interest-rate cut follows stress test change!

The interest-rate cut (for mortgages) that may be announced just as you're reading this comes on the heels of a change to the Federal Government's "stress test" and the combined benefit could lower mortgage rates by as much as 0.8 per cent!

The first week of March brought a 0.5-per-cent reduction to the Bank of Canada's interest rate...and there could be more to come.

"The Bank of Canada is probably going to cut again " said Justin Thouin, CEO of lowestrates.ca, during an interview on Bloomberg TV. "So variable rates may go down 75 basis points [0.75 of a per cent], and we may see fixed-rate mortgages test the 2 per cent threshold."

"The Bank of Canada is probably going to cut again " said Justin Thouin, CEO of lowestrates.ca, during an interview on Bloomberg TV. "So variable rates may go down 75 basis points [0.75 of a per cent], and we may see fixed-rate mortgages test the 2 per cent threshold."

For first-time home buyers, that's on top of the 0.3 per cent mortgage-rate cut that "could" apply with the latest revision to the stress test, which was originally called Guideline B-20 before being renamed First-Time Home Buyers Incentive.

The rate cut, however, goes beyond people buying for the first time. Think about how much savings would apply for a buyer who is capable of taking on a mortgage of $500,000 — or more. Having such a low interest rate, assuming that the banks pass all or most of it on to consumers heading into the spring season, is likely to have an interesting impact on the real estate market at all levels.

Next month, the newest changes to the controversial test go into effect (April 6), and they are consistent with what you might have expected if you have been reading past references in this newsletter, News From Nexus.

The minimum qualifying rate for mortgages has been modified. In the Guideline B-20, borrowers seeking an uninsured mortgage from a federally regulated financial institution had to qualify at a rate 200 basis points over what they’re applying for, or at a rate that matches the Bank of Canada’s five-year benchmark rate, whichever is higher.

On April 6, that changes.

The “benchmark rate” that was calculated over five years and based on the Bank of Canada's rate will now be based on the weekly five-year insured-mortgage rate. In other words, based on mortgage rates offered by lenders. Analysts estimate this will make a difference of 30 basis points, or 0.3 per cent.

The rate cut, however, goes beyond people buying for the first time. Think about how much savings would apply for a buyer who is capable of taking on a mortgage of $500,000 — or more. Having such a low interest rate, assuming that the banks pass all or most of it on to consumers heading into the spring season, is likely to have an interesting impact on the real estate market at all levels.

Next month, the newest changes to the controversial test go into effect (April 6), and they are consistent with what you might have expected if you have been reading past references in this newsletter, News From Nexus.

The minimum qualifying rate for mortgages has been modified. In the Guideline B-20, borrowers seeking an uninsured mortgage from a federally regulated financial institution had to qualify at a rate 200 basis points over what they’re applying for, or at a rate that matches the Bank of Canada’s five-year benchmark rate, whichever is higher.

On April 6, that changes.

The “benchmark rate” that was calculated over five years and based on the Bank of Canada's rate will now be based on the weekly five-year insured-mortgage rate. In other words, based on mortgage rates offered by lenders. Analysts estimate this will make a difference of 30 basis points, or 0.3 per cent.

The “stress test” is generally considered to be more useful in small markets than large, high-priced markets like Vancouver because the mortgages are capped at $480,000.

The BC Real Estate Association hopes this will lead to more changes. BCREA continues to recommend that the stress test be reviewed while taking in the realities of local markets, and that existing mortgage holders be exempt from the stress test when renewing their mortgages.

The BC Real Estate Association hopes this will lead to more changes. BCREA continues to recommend that the stress test be reviewed while taking in the realities of local markets, and that existing mortgage holders be exempt from the stress test when renewing their mortgages.

The Federal Government has promised to continue monitoring the housing market and “make changes as appropriate.”

The spring real estate market — surprise!

With its fresh flowers sprouting and warmer weather peeking over the horizon, spring brings new life…to everything.That includes the real estate market, which traditionally experiences an uptick every spring.

Don’t be fooled into thinking it won’t happen this year, because it already is. The market is alive, and this is an observation — Jennifer’s and Dale’s — based on what they’re seeing more than what the statistics may or may not say.

There is a level of activity that indicates the market is recovering faster than many observers might have expected or predicted.

Is it sustainable?

Nobody knows that, of course, but more properties are selling at a faster pace and closer to (or even above) asking price.

And, officially, spring is still a few weeks away!

If you — or people you know — are thinking of buying or selling, now is the time to consider your options and contact Jennifer and Dale.

The 2020s: Vancouver 'special' when investing in housing

In part five of a series about the 2020s, News From Nexus explores investment opportunities in real estate. A reputable publication, The Financial Times, previewed the 2020s as a decade in which investing in housing would no longer be a slam-dunk. This article is about why and how…why that theory exists and how far-reaching it is, or isn’t.

Fifth in a series

One thing you need to know about the real estate market is this: There are always opportunities for good investments.

That will continue through the 2020s…ad infinitum, especially in Vancouver, where supply and demand are unique because there is always going to be a limited supply of property in an attractive city that is bordered on three sides by mountains, ocean and the U.S.

That will continue through the 2020s…ad infinitum, especially in Vancouver, where supply and demand are unique because there is always going to be a limited supply of property in an attractive city that is bordered on three sides by mountains, ocean and the U.S.

Few cities are comparable.

Even in such limited space, there are still investment opportunities in real estate, because while the supply is limited there is almost always a net-in of migration...more people coming than going.

When The Financial Times previewed the new decade, it looked into the future for housing as an investment and projected that housing would no longer be a safe bet and that investors would be re-thinking and diversifying their portfolios because:

that investors would be re-thinking and diversifying their portfolios because:

Even in such limited space, there are still investment opportunities in real estate, because while the supply is limited there is almost always a net-in of migration...more people coming than going.

When The Financial Times previewed the new decade, it looked into the future for housing as an investment and projected that housing would no longer be a safe bet and

that investors would be re-thinking and diversifying their portfolios because:

that investors would be re-thinking and diversifying their portfolios because: • low interest rates and foreign ownership had inflated real estate markets

• the 2020s would bring lower capital growth and lacklustre wage increases

• price growth would be generated principally by inflation and rental yields

While all of this may turn out to be true in some market segments and geographic areas, in others it may not. Greater Vancouver is fortunate enough to be a geographic area with investment opportunities for real estate because of the immigration influx usually exceeds the outflow by tens of thousands of people.

And when that happens, there's going to be demand for that limited supply.

Within that desirable “geographic area” are niche markets. Some will offer attractive investments, some will not. Just like some provinces (and cities) will and some will not.

In what this year has evolved into a balanced market, more houses are selling for close to the asking price whereas a year ago that was not the case. That is likely to continue into this new decade, at least in some market segments.

As uncertainty grows with the spread of the coronavirus, stock markets may be unsettled. But when investors exit from owning equities (stocks), what are they going to do with the money they have to invest? They will find that some kinds of real estate, at least, are more attractive than stocks and if they even put five per cent of their investment portfolio into real estate, the effect will be enormous.

If you assume that most people have investments in pension funds, it’s logical that the pension fund managers could find it makes economic sense to invest more in building apartment buildings, as an example, than in maintaining a stock-heavy fund or a bond-heavy fund with small returns.

Not everybody can invest in apartment buildings, of course, but consider a millennial couple that is currently renting an apartment or small house. With interest rates so low, and if a couple can put together a down payment, the monthly payments could be close enough to what is being paid in rent. At the end of it all, the couple will own the property.

It’s true, as The Financial Times pointed out, that housing was a safer investment across the board when it was influenced by the international money of foreign ownership, but nobody knows what investment opportunities tomorrow will bring.

Economists have said the markets were too high because the bond yields were too low, and that a trigger would create a market correction. Two months ago, who could have imagined the unsettling effect on the markets would be triggered by a virus?

And with the Bank of Canada's 0.5-per-cent drop in interest rates, real estate becomes even more attractive from an investment standpoint.

• the 2020s would bring lower capital growth and lacklustre wage increases

• price growth would be generated principally by inflation and rental yields

While all of this may turn out to be true in some market segments and geographic areas, in others it may not. Greater Vancouver is fortunate enough to be a geographic area with investment opportunities for real estate because of the immigration influx usually exceeds the outflow by tens of thousands of people.

And when that happens, there's going to be demand for that limited supply.

Within that desirable “geographic area” are niche markets. Some will offer attractive investments, some will not. Just like some provinces (and cities) will and some will not.

In what this year has evolved into a balanced market, more houses are selling for close to the asking price whereas a year ago that was not the case. That is likely to continue into this new decade, at least in some market segments.

As uncertainty grows with the spread of the coronavirus, stock markets may be unsettled. But when investors exit from owning equities (stocks), what are they going to do with the money they have to invest? They will find that some kinds of real estate, at least, are more attractive than stocks and if they even put five per cent of their investment portfolio into real estate, the effect will be enormous.

If you assume that most people have investments in pension funds, it’s logical that the pension fund managers could find it makes economic sense to invest more in building apartment buildings, as an example, than in maintaining a stock-heavy fund or a bond-heavy fund with small returns.

Not everybody can invest in apartment buildings, of course, but consider a millennial couple that is currently renting an apartment or small house. With interest rates so low, and if a couple can put together a down payment, the monthly payments could be close enough to what is being paid in rent. At the end of it all, the couple will own the property.

It’s true, as The Financial Times pointed out, that housing was a safer investment across the board when it was influenced by the international money of foreign ownership, but nobody knows what investment opportunities tomorrow will bring.

Economists have said the markets were too high because the bond yields were too low, and that a trigger would create a market correction. Two months ago, who could have imagined the unsettling effect on the markets would be triggered by a virus?

And with the Bank of Canada's 0.5-per-cent drop in interest rates, real estate becomes even more attractive from an investment standpoint.

Next month: How technology could transform property markets in the 2020s

What our clients are saying...

“Trust is huge…selling your home of fifty years is a very big adventure in your life, and you really want someone you feel comfortable with — that’s Dale and Jennifer, through and through. In our experience, you’d never find more caring, knowledgeable and dedicated folks than Dale and Jennifer. We missed them when it was over!”

— Dick and June Smith, West Vancouver

— Dick and June Smith, West Vancouver

Keep an eye on changes to strata insurance policies

You may have noticed a lot of time spent on television newscasts, and space in newspapers on and off line, about insurance premiums for condominium stratas in Greater Vancouver.

You may have noticed a lot of time spent on television newscasts, and space in newspapers on and off line, about insurance premiums for condominium stratas in Greater Vancouver. Premiums in some areas have increased, and stratas understandably pass that on to their members. For potential homeowners obviously not affected, it’s an opportunity to explore in advance an issue that in the past is sometimes overlooked.

For Nexus Realty clients (and for all clients), awareness is critical.

For Nexus Realty clients (and for all clients), awareness is critical.

People who want to buy a condo when represented by Nexus are always provided with solid and thorough information about the importance of having a subject condition relating to strata insurance when they make an offer. They are encouraged to include a clause that ensures they're satisfied with condominium insurance. We are committed to making sure they don’t buy into a problem.

They are also provided with information to help them understand the type of building that has resulted in increased premiums and deductibles. There can be many reasons for the increases. In fact, some increases in premiums can be the result of decreases in deductibles.

Now, the BC Real Estate Association is lobbying to have the government make it mandatory for the strata corporations to provide complete strata insurance policy information for buyers.

They are also provided with information to help them understand the type of building that has resulted in increased premiums and deductibles. There can be many reasons for the increases. In fact, some increases in premiums can be the result of decreases in deductibles.

Now, the BC Real Estate Association is lobbying to have the government make it mandatory for the strata corporations to provide complete strata insurance policy information for buyers.

In a letter to the Ministry of Municipal Affairs and Housing, the BCREA has asked that a clause requiring proof of insurance be added to protect all buyers by making it mandatory for them to know the “terms, premiums, amounts of deductible of coverage limits." The subject-condition clause has already been distributed to realtors around the province so that they can include it as a condition of sale.

Buyers should always do their due diligence and their homework on strata insurance when buying a condo. You do need to check it out.

Jennifer and Dale are always happy to make sure you do that.

Jennifer and Dale are always happy to make sure you do that.

That the three most searched neighbourhoods in Greater Vancouver are (in order) Kitsilano, Cloverdale and White Rock, according to property page views on Real Estate Wire’s website, REW.ca?

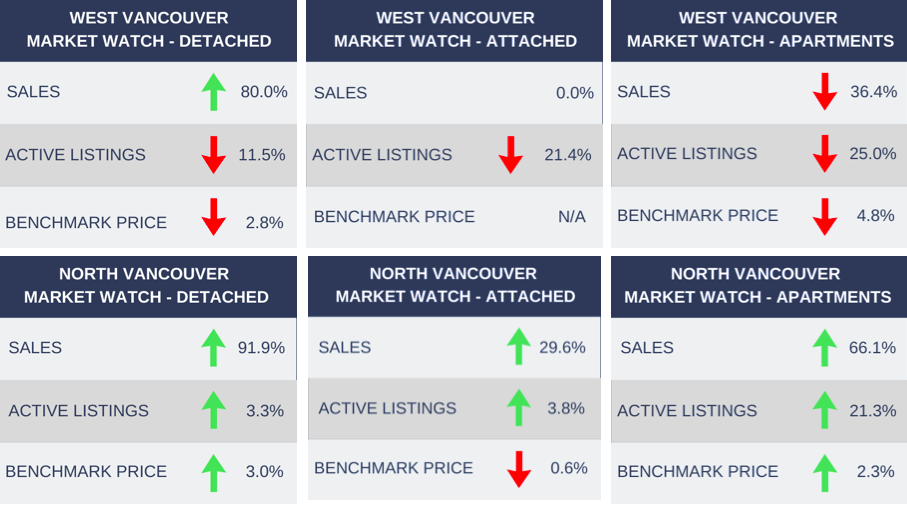

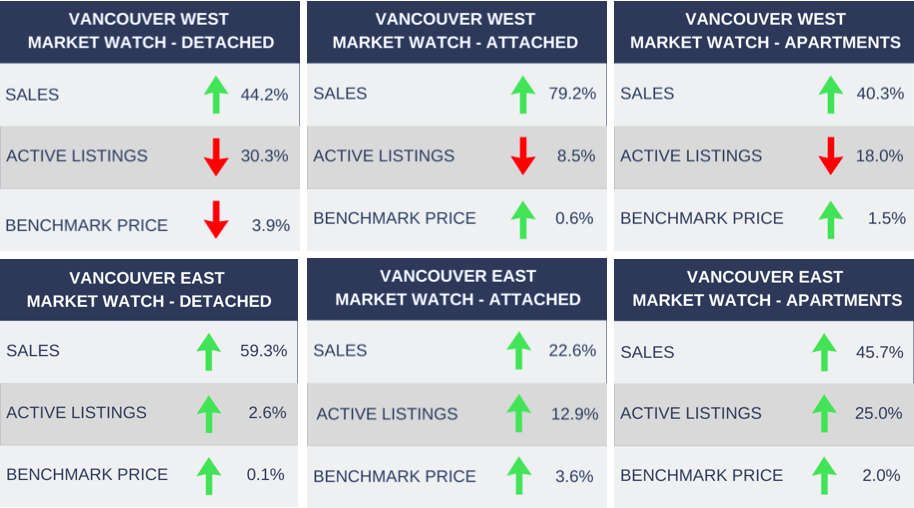

REBGV: Sales-to-active-listings ratio the telling story

Of all the encouraging statistics reported this month by the Real Estate Board of Greater Vancouver, and there were many, the one that jumped out was “sales-to-active-listings ratio.”If the sales-to-active-listings ratio is more than 20 per cent, analysts say that home prices experience upward pressure over several months…the corresponding number for downward pressure is 12 per cent.

The ratio for February for all properties was 23.4 per cent. In January, it was 18.2 per cent. In December, 23.4 per cent. In November, 23.2 per cent.

Breaking that down into categories, for detached homes February’s sales-to-active-listings ratio was 17.3 per cent; for townhomes 26.9 per cent and for apartments 28.4 per cent.

Here are the trending figures for each:

Detached homes — 11.6 per cent in January, 15.2 per cent in December, 17.2 per cent in November

Townhomes — 22.6 per cent in January, 25.7 per cent in December, 24.9 per cent in November

Apartments — 23.9 per cent in January, 32.5 per cent in December, 29.3 per cent in November

You be the judge.

The facts imply that there is more demand for townhomes and apartments, yet detached homes are also moving in the same direction.

In its monthly news release, the REBGV said that there is “increased traffic at open houses and multiple-offer scenarios in certain pockets of the market. If you’re considering listing your home for sale, now is a good time to act with increased demand, reduced competition from other sellers, and some upward pressure on prices.”

Other notable statistics from February’s activity:

• In the four micro markets (North Vancouver, West Vancouver, Vancouver West, Vancouver East) that News From Nexus tracks every month (see complete stats below), sales are up in 10 of the 12 categories, even in one and down in one.

• All sales were up 44.9 per cent compared to February 2019.

• Compared to January 2020, the increase in sales was 36.9 per cent.

• New listings were up 2.8 per cent compared to February 2019 and 6.7 per cent compared to January 2020.

• Sales in all three categories showed modest increases from the previous month and large jumps from the previous year — 52.9 per cent for detached homes, 39.8 per cent for townhomes and 45.8 per cent for apartments.

Total homes listed for sale was higher than January by 6.7 per cent, but down 20.7 per cent from February 2019.

For this report, at least, the demand is much greater than the supply, especially in the condominium market.

And for people considering listing — or buying, it’s definitely food for thought.

Remember that there is fresh material on the Nexus website at least twice a week.

Blogs are posted regularly and there’s a library of past newsletters — plus this one of course!

Real Estate Monthly Statistics

The following statistics for West Vancouver, North Vancouver, Vancouver West and Vancouver East compare February 2020 to February 2019 (note: sales refers to number of sales, not to sale prices).