There’s some good news — perhaps — with this month’s newsletter, because there are at least some hints of change in real estate activity. Read on to find out what they are and what they could mean. It begins with the monthly news release from the Real Estate Board of Greater Vancouver, which always coincides with the release of the Nexus newsletter. Your thoughts about the newsletter and the Nexus website are always welcome.

There’s some good news — perhaps — with this month’s newsletter, because there are at least some hints of change in real estate activity. Read on to find out what they are and what they could mean. It begins with the monthly news release from the Real Estate Board of Greater Vancouver, which always coincides with the release of the Nexus newsletter. Your thoughts about the newsletter and the Nexus website are always welcome.Do Real Estate Board figures indicate a trend?

The monthly news release from the Real Estate Board of Greater Vancouver has uncovered figures that could be interpreted as a modest — and positive — change in market conditions.According to the REBGV’s monthly analysis, there is a moderate sales increase in the entire Greater Vancouver area, with total properties sold topping 2,000 for the first time this year, an increase of 44.2 per cent over the previous month. Also up was the number of properties listed

(14,685), the most since September 2014, and 5,861 new listings represent an increase over both May 2018 and April of this year.

(14,685), the most since September 2014, and 5,861 new listings represent an increase over both May 2018 and April of this year.The board continues to connect the federal government with the sluggish market conditions, stating that “high home prices and mortgage qualification issues caused by the federal government’s B20 stress test remain significant factors behind the reduced demand that the market is experiencing today.”

The news release reinforces what you have read in the past two issues of the Nexus newsletter, about how sensible pricing brings out the buyers and how analyzing the micro markets is the key. Here is what the REBGV release says:

“Whether you’re a buyer looking to make an offer or a seller looking to list your home, getting your pricing right is the key in today’s market. To be competitive, it’s important to work with your local realtor to assess and understand the latest trends in your neighbourhood and property type of choice.”

The monthly release also reveals another promising trend:

The sales-to-active-listings ratio last month was 18 per cent overall — 14.2 per cent for detached homes, 20 per cent for townhomes and 21.2 per cent for apartments. Generally, upward pressure on home prices occur when the ratio reaches 20 per cent, while downward pressure occurs when the ratio drops below 12 per cent, for sustained periods.

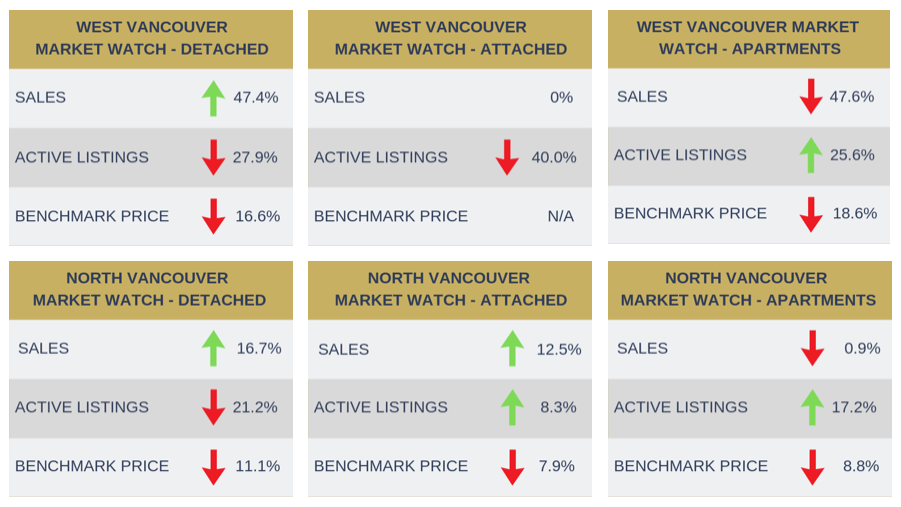

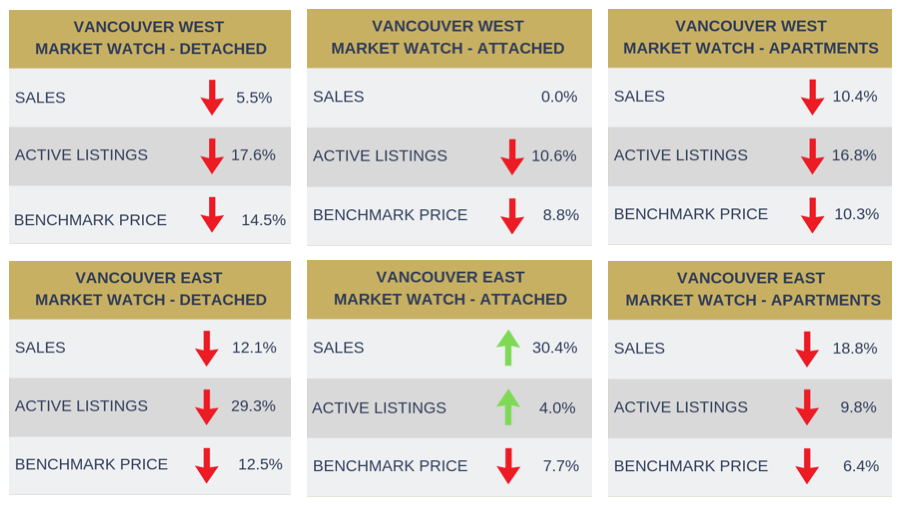

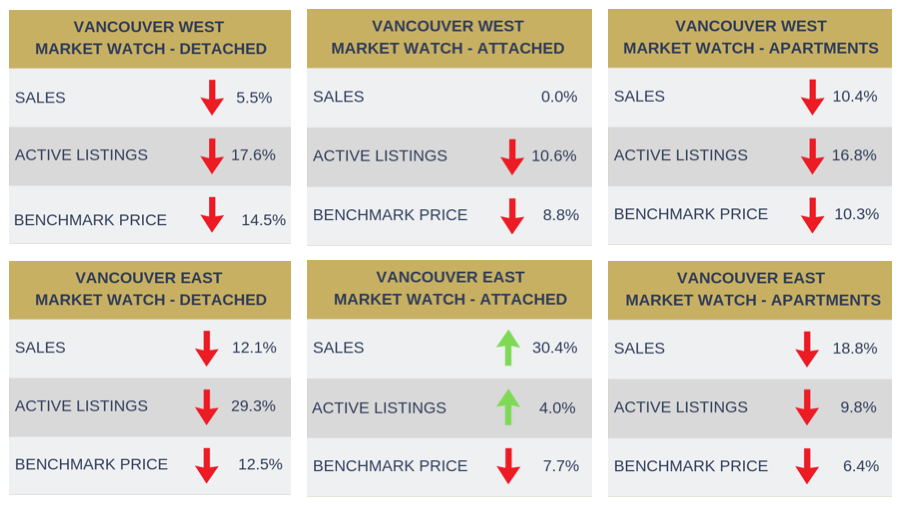

If you examine the four “micro markets” that we track in every newsletter — North Vancouver, West Vancouver, Vancouver West and Vancouver East — there is another sign. Of the 12 sales categories (detached, attached and apartments for each of the four micro markets), half of them are either up or exactly the same as May 2018. Just a month ago, only one of the 12 was up over the same month (April) from the previous year.

All of these things are indicators that the market is starting a recovery phase. That doesn’t mean it’s a guarantee, of course, but it’s beginning to look like there are trends that will produce a more active market.

Multiple offers lead to a sale over asking price

Eight offers on a property? Now that sounds like a headline from another era, doesn’t it?Not so fast…

Last month, eight offers on a West Vancouver listing resulted in a sale that was more than $100,000 over asking price. The property was

properly priced and it touched the level of affordability (we can’t take the credit — it was not our listing!). The affordability component is what attracted so many potential buyers.

properly priced and it touched the level of affordability (we can’t take the credit — it was not our listing!). The affordability component is what attracted so many potential buyers. In the last two newsletters, we’ve pointed out that — despite the less-than-optimistic real estate reports in the media — there are some good signs the market is turning and becoming more active. Our opinion is always based on facts, supported by a strong belief that when properties are sensibly priced, and micro markets are properly analyzed, real estate buyers will respond.

We diligently watch for signs like this. There’s a tendency to think there are few buyers, but it’s quite the opposite. The buyers are out there, and they surface once real estate prices reach their level of affordability.

This is the Nexus philosophy, and one reason why we believe first-time buyers should consider us:

Our first job is to “put up the goalposts.” We have to understand what you as a first-time buyer require and then provide you with the most complete market information that matches your wishes or needs. So first, we listen. After that, we broaden the parameters and zero in on different areas or neighbourhoods, exploring both listings and sales in areas that you might find appealing. We find out what your needs are, what your budget allows, what compromises you may have to make to find the best possible property, and what implications and regulations you’ll encounter in becoming a homeowner.

different areas or neighbourhoods, exploring both listings and sales in areas that you might find appealing. We find out what your needs are, what your budget allows, what compromises you may have to make to find the best possible property, and what implications and regulations you’ll encounter in becoming a homeowner.

We diligently watch for signs like this. There’s a tendency to think there are few buyers, but it’s quite the opposite. The buyers are out there, and they surface once real estate prices reach their level of affordability.

Are you a first-time buyer?

If you’ve never been a homeowner and you live in the Lower Mainland, the prospect of becoming one can be daunting or intimidating. That’s where choosing the right realtor can address and perhaps alleviate first-time buyer concerns.This is the Nexus philosophy, and one reason why we believe first-time buyers should consider us:

Our first job is to “put up the goalposts.” We have to understand what you as a first-time buyer require and then provide you with the most complete market information that matches your wishes or needs. So first, we listen. After that, we broaden the parameters and zero in on

different areas or neighbourhoods, exploring both listings and sales in areas that you might find appealing. We find out what your needs are, what your budget allows, what compromises you may have to make to find the best possible property, and what implications and regulations you’ll encounter in becoming a homeowner.

different areas or neighbourhoods, exploring both listings and sales in areas that you might find appealing. We find out what your needs are, what your budget allows, what compromises you may have to make to find the best possible property, and what implications and regulations you’ll encounter in becoming a homeowner. After zeroing in on the best matches, and seeing them of course, the key question we will have for you is this:

“Will you want to come home to this place every night?”

If you’re not going to be excited by that, then it’s the wrong home. You have to know you’re going to be happy there. That’s the final test.

We don’t put pressure on you, but we make sure you understand everything. Then we find the home that makes you happy.

Money laundering and real estate

“Will you want to come home to this place every night?”

If you’re not going to be excited by that, then it’s the wrong home. You have to know you’re going to be happy there. That’s the final test.

We don’t put pressure on you, but we make sure you understand everything. Then we find the home that makes you happy.

Money laundering and real estate

There are reports that alleged money laundering has had a devastating impact on real estate in British Columbia. While it’s clear that illegal money through our economy does have an impact on everything, including real estate, nobody really knows to what extent, so it remains to be seen what the true impact will be when the investigations are complete.

An article in Business in Vancouver last month pointed out that the slide in real estate prices was underway since 2017 or “long before the release of multiple high profile reports on money laundering” and that there were other factors contributing factors to the falling prices. Until there is hard data to back up the opinions, nobody will know either the impact the money laundering has had, nor the impact it will have if the illegal money ceases to exist.

“Dale and Jennifer helped me sell my family home in West Vancouver in the spring of 2007. Their services were highly recommended to me by several members of my church group, and my first meeting with them showed that I could place full confidence in their abilities. They are clearly experienced, and took care of numerous details I would never have thought of, such as arranging for minor but strategic landscaping to show the property as a whole to its best advantage. In all aspects, they were truly outstanding. They obtained the services of an appraiser, surveyor and a real estate photographer; prepared promotional materials for publication and printed copies for wide distribution; met with other realtors and potential buyers; and answered all questions.

experienced, and took care of numerous details I would never have thought of, such as arranging for minor but strategic landscaping to show the property as a whole to its best advantage. In all aspects, they were truly outstanding. They obtained the services of an appraiser, surveyor and a real estate photographer; prepared promotional materials for publication and printed copies for wide distribution; met with other realtors and potential buyers; and answered all questions.

This month’s featured testimonial

From Dr. Irena Glasgow, formerly of West Vancouver:“Dale and Jennifer helped me sell my family home in West Vancouver in the spring of 2007. Their services were highly recommended to me by several members of my church group, and my first meeting with them showed that I could place full confidence in their abilities. They are clearly

experienced, and took care of numerous details I would never have thought of, such as arranging for minor but strategic landscaping to show the property as a whole to its best advantage. In all aspects, they were truly outstanding. They obtained the services of an appraiser, surveyor and a real estate photographer; prepared promotional materials for publication and printed copies for wide distribution; met with other realtors and potential buyers; and answered all questions.

experienced, and took care of numerous details I would never have thought of, such as arranging for minor but strategic landscaping to show the property as a whole to its best advantage. In all aspects, they were truly outstanding. They obtained the services of an appraiser, surveyor and a real estate photographer; prepared promotional materials for publication and printed copies for wide distribution; met with other realtors and potential buyers; and answered all questions. “Thanks to this thorough preparation, the house was sold on the first day on which offers were invited.

"The residential real estate market at that time was very dynamic, with values changing rapidly and dramatically. Yet the closing price was at the top of the range that I thought my house could be expected to get, and so I have no doubt that Dale and Jennifer helped my family obtain the best possible result.

“Their professional assistance continued well beyond the closing of the sale. In the transitional period when I was preparing to relocate, their advice and generous offers of practical help were invaluable to me in dealing with the details of closing up the house, disposing of its contents and moving to my new home in another community.

“For all these reasons, my family and I have nothing but praise for Dale and Jennifer. I am happy to repay my gratitude to them now by recommending their outstanding professional abilities and their personal qualities of kindness and generosity without any qualification.”

There are 61 days in June and July…and 116 cruise ships going in and out of Vancouver. So if you’re living in or visiting an ocean-view property that looks down on Burrard Inlet between now and the end of next month, you might want to check out the list of ships that’s regularly posted on the Nexus Realty website.

There are just six “dark days” in June and July — the 11th, 13rd and 18th of June and the 4th, 9th and 16th of July — when no cruise ships will be in port. It’s the busiest two-month period for ships to stop in Vancouver.

This month’s complete list includes arrival and departure times for every ship — click on a ship’s link to find out more about it — and is updated regularly.

"The residential real estate market at that time was very dynamic, with values changing rapidly and dramatically. Yet the closing price was at the top of the range that I thought my house could be expected to get, and so I have no doubt that Dale and Jennifer helped my family obtain the best possible result.

“Their professional assistance continued well beyond the closing of the sale. In the transitional period when I was preparing to relocate, their advice and generous offers of practical help were invaluable to me in dealing with the details of closing up the house, disposing of its contents and moving to my new home in another community.

“For all these reasons, my family and I have nothing but praise for Dale and Jennifer. I am happy to repay my gratitude to them now by recommending their outstanding professional abilities and their personal qualities of kindness and generosity without any qualification.”

Seeing ships from ocean-view properties

Seeing ships from ocean-view properties

There are 61 days in June and July…and 116 cruise ships going in and out of Vancouver. So if you’re living in or visiting an ocean-view property that looks down on Burrard Inlet between now and the end of next month, you might want to check out the list of ships that’s regularly posted on the Nexus Realty website.There are just six “dark days” in June and July — the 11th, 13rd and 18th of June and the 4th, 9th and 16th of July — when no cruise ships will be in port. It’s the busiest two-month period for ships to stop in Vancouver.

This month’s complete list includes arrival and departure times for every ship — click on a ship’s link to find out more about it — and is updated regularly.

That two-thirds of economists polled the news agency Reuters predict that

the Bank of Canada interest rates will either be lower or unchanged

by the end of 2020?

Real Estate Monthly Statistics

The following statistics for West Vancouver, North Vancouver, Vancouver West and Vancouver East compare

May 2019 to May 2018 (note: sales refers to number of sales, not to sale prices).

Benchmark Price: Estimated sale price of a benchmark property. Benchmarks represent a typical property within each market.

To see more information on local stats, please CLICK HERE.