Each month, we compile statistics, articles, thoughts and even events that we think will be of interest and relevance to our readers. The previous month’s statistics come from the Real Estate Board of Greater Vancouver, and we select what we think will give you a snapshot of the most recent market conditions and real estate trends. As always, your feedback is welcome.

- Jennifer and Dale

Character Homes: a ground-floor opportunity

The reason you’re reading a lot about Character Homes in the City of Vancouver in this newsletter, and on our website, is quite simple. This is a real estate opportunity that comes with a lot of good adjectives — valuable, exciting, potentially profitable, unique, affordable and timely.

Timely?

Everybody likes to get in on the ground floor of an opportunity, whether it’s playing the stock market or buying real estate. When it comes to Character Homes, this is the ground floor.

Here’s why:

• Character Homes are old, yet new. They were built 80 years ago, or more. In the City of Vancouver, that generally qualifies them for this new opportunity.

• The chance to buy a Character Home and make it into affordable, valuable and perhaps profitable living hasn’t caught on, but it will.

• If the lots are the right size and if the Character Homes regulations are followed, it’s possible for three homeowners to live independently on the same piece of land, sharing the cost of the property, and own their portion of that property (in a mini-strata).

• Sharing the cost means buying the land below market value. As the idea of building out from the existing Character Home becomes more popular, the cost and value of the land is likely to mushroom.

• On a lot that currently has one structure, there would be three: the original Character Home that must be preserved to city qualifications; a duplex attached to it and a laneway house. The sizes of each would depend in part on the size of the lot, but each would be “a home.”

Buying a home always starts with the cost of the lot (location, location, location) and in the City of Vancouver that’s almost always the most expensive component.

While the Character Homes process can be complicated, it’s eminently do-able and when it starts to catch on, it’s going to cost more than it does when you get in on the ground floor.

Now is the ground floor.

Stressful times for mortgage stress test?

In a Financial Post story this month, Canada’s stress test for uninsured mortgages was defended by a federal banking regulator at a luncheon in Toronto.Carolyn Rogers, assistant superintendent at the Office of the Superintendent of Financial Institutions, said in her speech to the Economic Club of Canada:

“The stress test is, quite simply, a safety buffer that ensures a borrower doesn’t stretch their borrowing capacity to its maximum, and leaves no room to absorb unforeseen events. This is simply prudent…for the bank and for the borrower.”

The stress test — introduced in 2018 — makes it necessary for all Canadian home buyers applying for a mortgage to qualify at either the Bank of Canada’s five-year benchmark or the rate on their contract plus 200 basis points. This applies even when making a down payment of 20 per cent or more. Previously the stress test applied only to your mortgage if you made a down payment of less than 20 per cent.

Implemented in January of last year, the test has been criticized for its impact on real estate sales, as well as for driving borrowers to unregulated lenders.

Paul Taylor, President and CEO of Mortgage Professionals Canada, said stress tests “will suppress home buying” and pose a potential risk to house prices and the broader economy. In a statement he added: “Our report illustrates that a more reasonable stress test level and lending restriction reforms are now needed to strike a better balance for borrowers and policymakers, improving housing affordability and Canada’s economy.”

Rogers said with interest rates historically low, and personal debt levels historically high, the stress test provides a “margin of safety” and it is monitored regularly and should be adjusted if the environment’s conditions change.

Nexus Note:

Listen to the experts on both sides of the issue. Find the middle ground and establish a moderate position. That would both address limiting the risk and enable buyers to achieve home ownership.

Sales, prices still benefit Vancouver buyers

The buyer’s market continues to grow in Metro Vancouver, according to the latest statistics released by the Real Estate Board of Greater Vancouver.In January, there were 4,848 new listings (detached and attached homes, plus apartments), an increase of 244.6 per cent in new listings from the previous month, and 27.7 increase over the same month a year ago.

With home sales, on the other hand, the story was different. There was a decrease of 39.3 per cent compared to January 2018, but a 2.9 per cent increase over December 2018.

The impact is being felt, naturally, in house prices. The rule of thumb is that when less than 12 per cent of active listings are sales, prices can be expected to drop. In January, the sales-to-active listings ratio was 10.2 per cent for all types of property, calculated from a 6.8 per cent for detached homes, 11.9 for townhomes and 13.6 per cent for apartments.

In January 2019, the actual number of residences sold in each category throughout the Metro Vancouver market was:

• 339 detached homes

• 205 attached homes

• 559 apartments

The composite benchmark price for all residential homes, according to the REBGV and calculated by the MLS® Home Price Index, is $1,019,600. This represents a decrease of 4.5 per cent from a year ago.

Nexus Note:

As is always the case with this type of market, it creates great opportunities for buyers who are interested in getting into the market, or for investors who want to capitalize on the drop in home prices. And houses are still selling in this market, when you have a realtor who knows how to connect the people and the property.

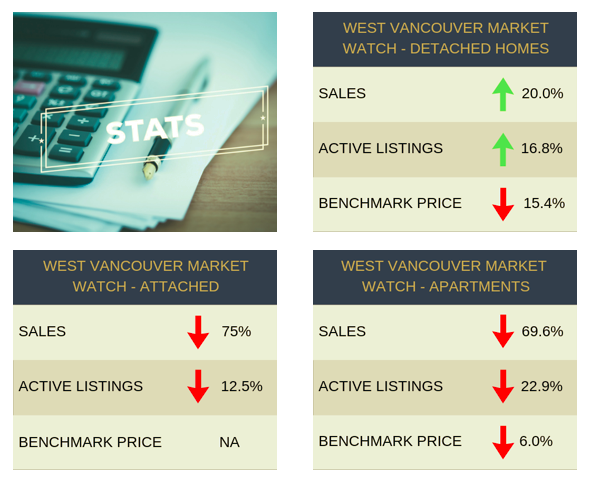

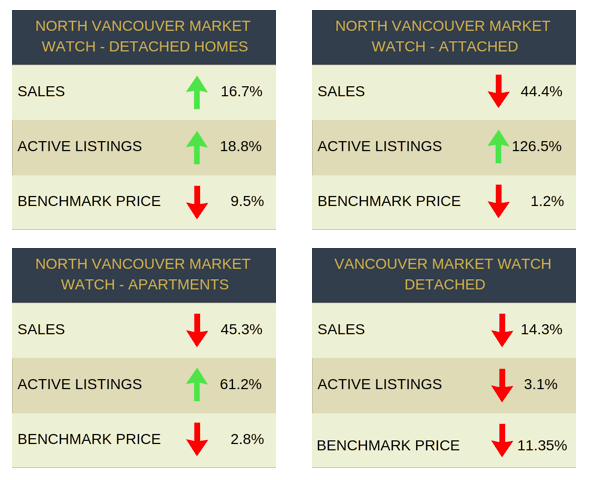

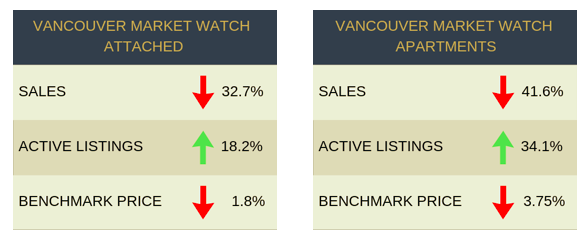

Real Estate Monthly Statistics

Stats are calculated comparing January 2019 to January 2018 (note: sales refers to number of sales, not to sale prices).

Benchmark Price: Estimated sale price of a benchmark property. Benchmarks represent a typical property within each market.

To see more information on local stats, please CLICK HERE

To see more information on local stats, please CLICK HERE