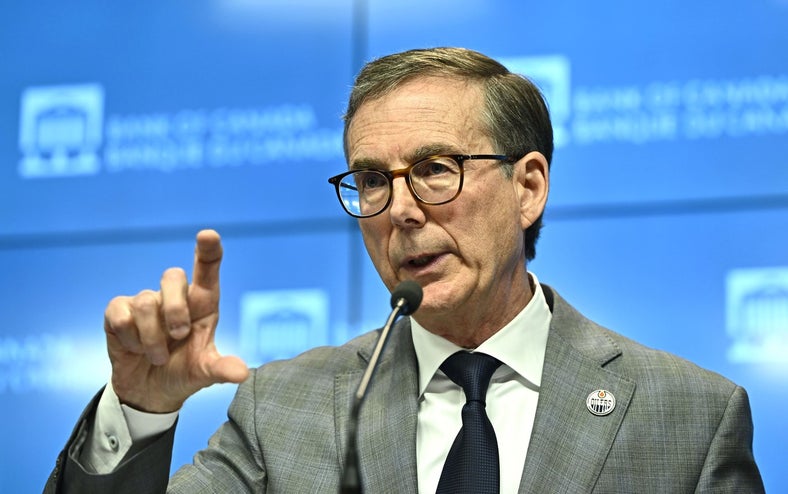

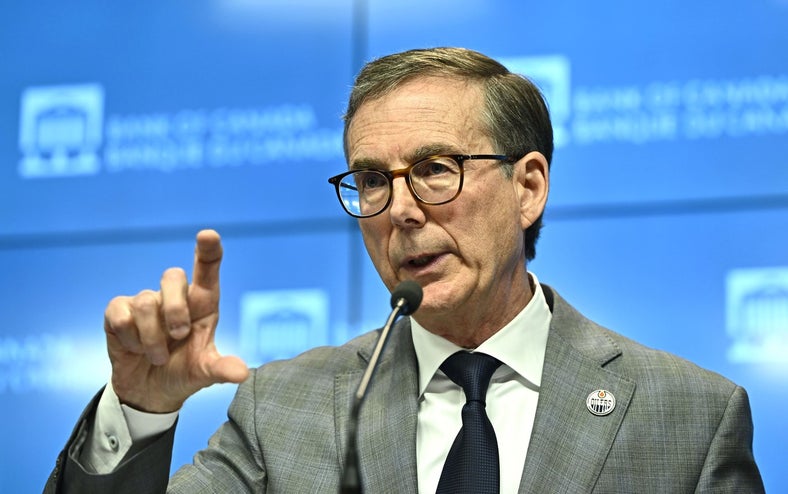

The message is clear from the Bank of Canada, and it should at least be encouraging for homeowners: record-high interest rates are now trending in the right direction with a drop of .25 per cent. The “overnight rate” is down to 4.50 per cent. “Looking ahead, we expect inflation to moderate further, though progress over the next year will likely be uneven,” Macklem said at a press conference. “If inflation continues to ease broadly in line with our forecast, it is reasonable to expect further cuts in our policy interest rate.”

“Looking ahead, we expect inflation to moderate further, though progress over the next year will likely be uneven,” Macklem said at a press conference. “If inflation continues to ease broadly in line with our forecast, it is reasonable to expect further cuts in our policy interest rate.”

The latest cut is the second in a row — both of them by a quarter of a per cent — after four years of zero cuts, and it was accompanied by this forecast by the Bank’s Governor, Tiff Macklem:

“Looking ahead, we expect inflation to moderate further, though progress over the next year will likely be uneven,” Macklem said at a press conference. “If inflation continues to ease broadly in line with our forecast, it is reasonable to expect further cuts in our policy interest rate.”

“Looking ahead, we expect inflation to moderate further, though progress over the next year will likely be uneven,” Macklem said at a press conference. “If inflation continues to ease broadly in line with our forecast, it is reasonable to expect further cuts in our policy interest rate.”The Bank’s forecast is based on inflation.

“Our forecast has inflation declining gradually,” Macklem said. “[While] it is reasonable to expect further cuts…the timing is going to depend on incoming data and, importantly, what that data tells us about where inflation is headed.”

Analysts are speculating there will be more cuts by the end of the calendar year, with the next announcement scheduled for September 4. The Federal Government’s inflation target is 2.0 per cent per year, and it’s currently 2.75 per cent, within the anticipated range of 2.0 to 3.0 per cent.

Real Estate Wire offered this promising opinion: “This overall path by the Bank of Canada should increase buyer confidence and improve the health of the real estate market over the coming year and a half.”

When the latest rate cuts will impact mortgage rates and housing activity remains to be seen. Buyers have been waiting for cuts, and existing mortgage holders are still facing renewals that are not only much higher but also subject to re-qualifying at higher rates as well.

When the latest rate cuts will impact mortgage rates and housing activity remains to be seen. Buyers have been waiting for cuts, and existing mortgage holders are still facing renewals that are not only much higher but also subject to re-qualifying at higher rates as well.

For more about the “stress test” watch for News From Nexus, the monthly newsletter that will be delivered to subscribers next week. To become a subscriber, enter your email address in the box at the bottom of this page.