July brings positive signs for real estate

There is reason to be cautiously optimistic about the real estate market, based on the monthly analysis provided by the Real Estate Board of Greater Vancouver.The most compelling indicator might be the sales-to-active listings ratio for July. If you’re a regular reader, you may be familiar with its meaning. For those who are not, if that ratio is 12 per cent or less, analysts say that puts downward pressure on home prices. If it’s 20 per cent or more, they say it means upward pressure on home prices.

Here is what the July figures showed for the sales-to-active listings ratio:

Here is what the July figures showed for the sales-to-active listings ratio: a) 18 per cent for all properties

b) 13.5 per cent for detached homes

c) 20 per cent for townhomes

d) 22 per cent for apartments

The caveat is that these figures, according to the analysts, have to apply for a “sustained period” to indicate a trend. Hence, the “cautious” optimism.

There are some other optimistic signs.

Sales for all residential homes in Greater Vancouver were up 23.5 per cent over July 2018, and 23.1 per cent over June 2019. While the 23.5-per-cent increase was 7.8 per cent below the 10-year average for July, it’s important to note this is the largest year-to-year increase for any month since November 2017.

The REBGV put it this way:

“While home sale activity remains below long-term averages, we saw an increase in sales in July compared to the less active spring we experienced. Those looking to buy today continue to benefit from low interest rates, increased selection and reduced prices compared to the heated market a few years ago.”

There was also a slightly greater selection of properties, with an increase of 2.9 per cent in new listings compared to June…and a 17.3 increase in all listings compared to July of last year, although this was a 4.9 decrease from the previous month (June 2019).

In actual Greater Vancouver sales from July 2018 to July 2019, the increase was 32 per cent for detached homes, 33.6 per cent for townhomes and 15.2 per cent for apartments.

All are positive steps…baby steps.

b) 13.5 per cent for detached homes

c) 20 per cent for townhomes

d) 22 per cent for apartments

The caveat is that these figures, according to the analysts, have to apply for a “sustained period” to indicate a trend. Hence, the “cautious” optimism.

There are some other optimistic signs.

Sales for all residential homes in Greater Vancouver were up 23.5 per cent over July 2018, and 23.1 per cent over June 2019. While the 23.5-per-cent increase was 7.8 per cent below the 10-year average for July, it’s important to note this is the largest year-to-year increase for any month since November 2017.

The REBGV put it this way:

“While home sale activity remains below long-term averages, we saw an increase in sales in July compared to the less active spring we experienced. Those looking to buy today continue to benefit from low interest rates, increased selection and reduced prices compared to the heated market a few years ago.”

There was also a slightly greater selection of properties, with an increase of 2.9 per cent in new listings compared to June…and a 17.3 increase in all listings compared to July of last year, although this was a 4.9 decrease from the previous month (June 2019).

In actual Greater Vancouver sales from July 2018 to July 2019, the increase was 32 per cent for detached homes, 33.6 per cent for townhomes and 15.2 per cent for apartments.

All are positive steps…baby steps.

Baby Boomers a factor in real estate market

One of the great unknowns about real estate — in fact, one of the great unknowns, period — is the impending impact of Baby Boomers. And in case you think Baby Boomers/seniors are becoming irrelevant, there are now more seniors than children in the country, according to the latest Government of Canada census.

And it’s a demographic that will continue to increase.

How seniors affect real estate remains subjective.

One theory is that seniors are moving away from business/financial centres to smaller cities or towns, where they can get better bangs-for-their-bucks by purchasing the same size of home for less.

Another theory is they’re downsizing and moving closer to the business/financial centres — into the cities — and living in smaller homes or apartments, sometimes as renters.

Both theories imply there will be more “large, family homes” on the market in cities like Vancouver. And if you apply another theory — that millennials and Generation Z buyers don’t have the same appetite as their parents or grandparents for large family homes — the end result could be a surplus of such homes

millennials and Generation Z buyers don’t have the same appetite as their parents or grandparents for large family homes — the end result could be a surplus of such homes

And it’s a demographic that will continue to increase.

How seniors affect real estate remains subjective.

One theory is that seniors are moving away from business/financial centres to smaller cities or towns, where they can get better bangs-for-their-bucks by purchasing the same size of home for less.

Another theory is they’re downsizing and moving closer to the business/financial centres — into the cities — and living in smaller homes or apartments, sometimes as renters.

Both theories imply there will be more “large, family homes” on the market in cities like Vancouver. And if you apply another theory — that

millennials and Generation Z buyers don’t have the same appetite as their parents or grandparents for large family homes — the end result could be a surplus of such homes

millennials and Generation Z buyers don’t have the same appetite as their parents or grandparents for large family homes — the end result could be a surplus of such homes In the City of Vancouver, part of the solution is the Character Homes plan. That philosophy is well-detailed on the space devoted to it on the Nexus Realty website. This is an attractive option that can be affordable, valuable and even profitable — call us to find out more. However, since Character Homes are only those built before 1940, other large family homes don’t qualify.

Then what?

A logical alternative is for these homes to house more than one family, either through creating separate suites or turning the house into a duplex, depending on what’s allowed by a city’s bylaws. More and more people are renting out a part of their house as a suite, and all of these options help address the growing problem of affordable housing.

Either way, those big family homes that Baby Boomers have lived in for so many years can provide a solution to affordable living in big cities like Vancouver, at least, and to a lesser extent in smaller cities.

A logical alternative is for these homes to house more than one family, either through creating separate suites or turning the house into a duplex, depending on what’s allowed by a city’s bylaws. More and more people are renting out a part of their house as a suite, and all of these options help address the growing problem of affordable housing.

Either way, those big family homes that Baby Boomers have lived in for so many years can provide a solution to affordable living in big cities like Vancouver, at least, and to a lesser extent in smaller cities.

A picture worth 1,000 words

"As we were going through and sorting out many pictures, we came upon this one of the two of us, celebrating a great day in our life. The next great day was when you found us a home on Argyle."

— Ron and Ethel Youngberg, West Vancouver

Countdown to Mortgage Plan 2.0

With the Federal Government’s response to Stress Test criticism due to go into effect on September 2, we thought this would be a good time to do a comparison between Stress Test 1 (Guideline B-20) and Stress Test 2 (First-Time Home Buyers Incentive — FTHBI).Except for one thing: when it comes to comparing apples to apples, this is more like apples to chocolates.

So here comes Mortgage Plan 2.0, citing the thrust of each version of what the government believes will silence critics of its 18-month-old mortgage plan.

Stress Test 1 (January 2018):

It forced borrowers seeking an uninsured mortgage from a federally regulated financial institution to qualify at a rate 200 basis points over what they’re applying for, or at a rate that matches the Bank of Canada’s five-year benchmark rate, whichever is higher. Until then, first-time buyers could qualify with a minimum down payment of 20 per cent.

Cause: to reduce the risk of debt for borrowers by improving the quality of loans

Effect: in the view of most analysts, fewer home buyers.

Stress Test 2 (September 2019):

Focussing on first-time home buyers, it offers SEMs — Shared Equity Mortgages — to give Canada Mortgage and Housing Corporation (CMHC) up to a 10 per cent investment in the homes. The government will advance buyers 25-year interest-free loans of between five and 10 per cent of the purchase price, for existing or new homes, respectively. Loans are capped at $480,000. Applicants must have household income of $120,000.

Cause: to make homes more affordable for first-time buyers, primarily millennials

Effect: While there was early criticism from real-estate analysts when FTHBI was unveiled in the federal budget a few months ago, its impact on the market — positive or negative — will take some time.

That regularly there’s new information on the Nexus Realty home page, in the form of blogs that are written to inform and/or entertain you with news and commentary about issues related to the real estate world?

Water-view property and cruise ships

All year, we’ve listed the name (and link to) every cruise ship that visits Vancouver so that when you’re looking down on Burrard Inlet from a water-view property, you know what you’re looking at…even if you’re just visiting. It’s a regular feature on the Nexus Realty website and will continue to be until the cruise-ship season comes to an end.

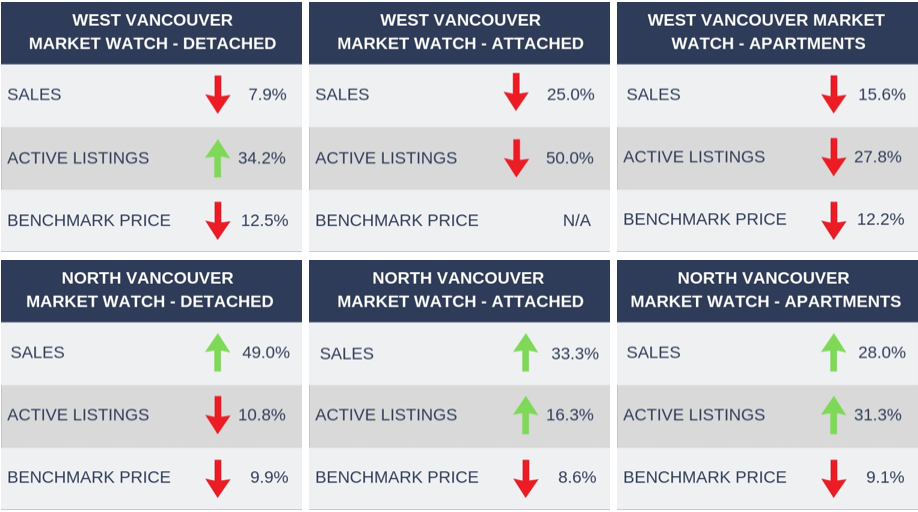

Real Estate Monthly Statistics

The following statistics for West Vancouver, North Vancouver, Vancouver West and Vancouver East

compare July 2019 to July 2018 (note: sales refers to number of sales, not to sale prices).

Benchmark Price: Estimated sale price of a benchmark property. Benchmarks represent a typical property within each market.

To see more information on local stats, please Click Here.